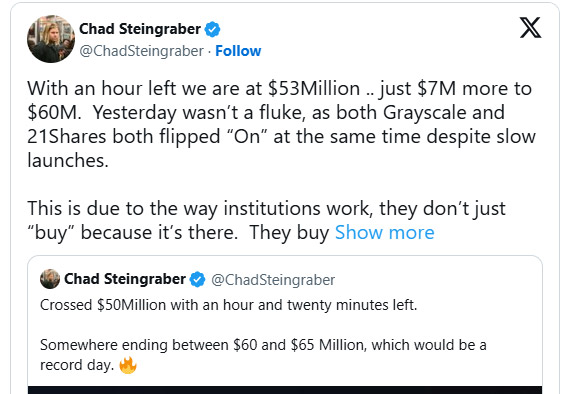

Exchange-traded funds (ETFs) linked to XRP surpassed $60 million in assets under management on December 17, according to market data, even as the token’s spot price declined over the same period.

XRP was trading lower at the time of reporting, extending losses from the previous week. The contrast between rising ETF assets and falling spot prices has caught the attention of market participants, raising questions about the relationship between institutional inflows and short-term price performance.

Crypto market commentator Chad Steingraber explained on X that the operational mechanics of ETFs may help clarify this divergence. ETF shares trade on regulated exchanges during standard market hours, while net fund flows are calculated at the end of the trading day. As a result, fund managers typically execute purchases of the underlying XRP after the market closes. This structure means that ETF inflows do not always translate into immediate buying pressure in the spot market.

Market analysts also note that institutional investment decisions tend to unfold gradually. Lengthy due diligence processes, internal risk assessments, and approval procedures can take weeks or even months to complete. Consequently, growth in ETF assets under management may reflect phased capital deployment rather than rapid accumulation of XRP positions.

XRP technical outlook

XRP has remained under persistent downward pressure for several months. On higher time frames, traders have identified a well-defined downtrend, with multiple technical indicators pointing to the risk of further declines since mid-year. Recent price action has tested key support zones, and analysts warn that a sustained break below current support could shift attention toward lower price ranges.

While the increase in XRP ETF assets signals growing institutional interest, the scale of these products remains relatively small compared with assets under management in larger cryptocurrency ETFs, according to market data. ETF managers may also employ strategies such as hedging, staggered purchases, or other allocation techniques that influence both the timing and magnitude of XRP spot market buying, potentially muting short-term price effects.

On-chain data from the XRP Ledger shows a recent increase in the number of non-empty wallets, suggesting that some investors are accumulating XRP during the ongoing price pullback.

Overall, the rise in ETF assets points to a gradual increase in institutional participation, while spot price action continues to reflect near-term selling pressure. Market participants are now watching whether end-of-day ETF rebalancing will translate into stronger spot demand and whether current technical support levels can hold in the sessions ahead.

Ready to start trading Forex? Join iXBroker today and kick-start your trading journey now!