The Japanese yen is tumbling to its lowest level in over 20 years, even as the Bank of Japan (BoJ) raises interest rates. On the surface, this seems counterintuitive: higher rates should attract capital and strengthen a currency. Yet the yen’s decline reflects deeper structural and market dynamics.

More sellers than buyers

A simple but surprisingly accurate way to describe the current situation comes from a former Goldman currency trader: “there were more sellers than buyers.” Despite higher rates, global investors are still selling yen, pushing it lower. The yen has even dropped below mid-2024 lows when Japanese rates were much lower, showing that the market’s appetite for Japanese assets remains constrained.

Interest rates versus market reality

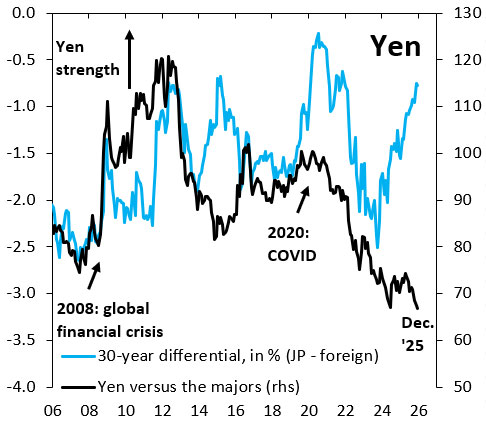

Longer-term Japanese government bond yields have risen sharply this year, boosting the 30-year yield differential in favor of the yen. Normally, this would attract capital and support the currency. Yet the yen continues to fall, illustrating that interest rates alone cannot offset other pressures.

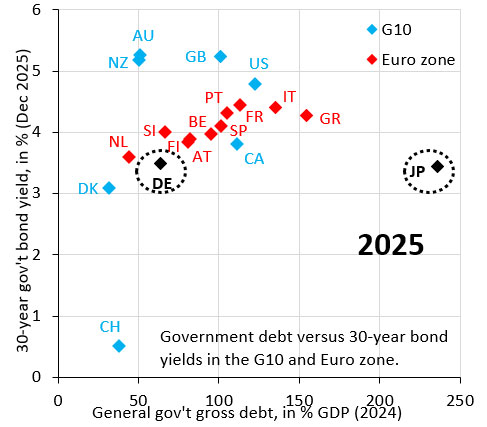

The core issue lies in Japan’s massive government debt. Even with higher yields, Japanese bonds remain artificially cheap because the BoJ continues to be a major buyer of government debt. This suppresses risk premia that would otherwise emerge in the bond market. Instead, those risks are reflected in the yen’s depreciation.

Structural debt concerns

Markets perceive a rising risk of a Japanese debt crisis. Until yields are allowed to rise to levels that reflect the true risk of holding Japanese debt, the yen is unlikely to stabilize. This implies that fiscal consolidation — reducing debt and narrowing deficits — is necessary for a sustained currency recovery.

In short, Japan’s yen continues to weaken not because rates are too low in isolation, but because market participants see significant structural risk in Japan’s fiscal position. Yen depreciation is the market’s way of pricing in that risk until Japan addresses its debt challenge.

Ready to start trading Forex? Join iXBroker today and kick-start your trading journey now!