Warner Bros. Discovery (WBD) has emerged as one of 2025’s quieter turnaround stories. The stock is up roughly 160% year to date and has gained about 44% over the past three months, marking a sharp reversal from the prolonged weakness that followed the company’s post-merger struggles.

The rally has been supported by a clearer balance sheet narrative, sustained cost discipline, and renewed optimism surrounding the Max streaming platform. A 30-day gain of just over 20% has added to already strong year-to-date momentum, contributing to a notable recovery in multi-year total shareholder returns.

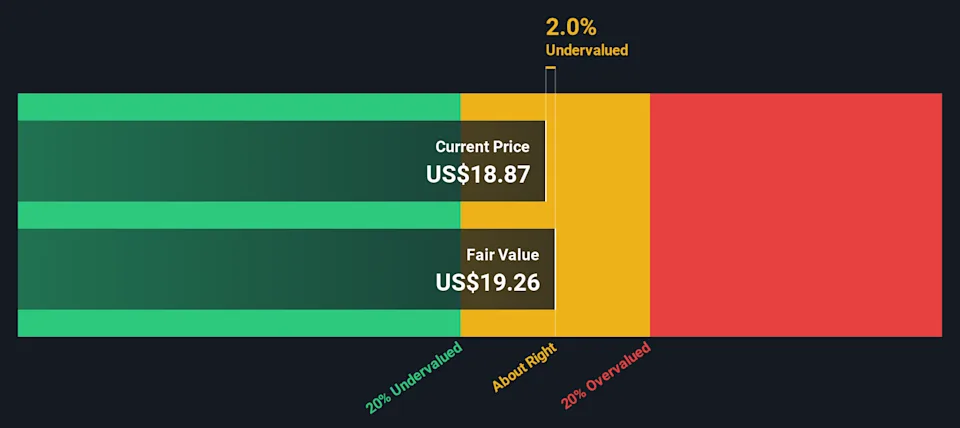

With WBD now trading near analysts’ valuation targets, investors are increasingly questioning whether the upside has largely been realized – or whether the market is still underestimating the company’s longer-term recovery potential.

Valuation debate intensifies after sharp rebound

At recent levels, Warner Bros. Discovery closed at $27.77, above a commonly cited narrative fair value of $24.10, implying the stock may be around 15% overvalued based on consensus assumptions.

This view reflects expectations that revenue will decline by approximately 0.6% annually over the next three years, even as margins and free cash flow improve. Analysts point to ongoing debt reduction, aggressive cost controls, and the expected financial relief from sports rights repricing — including the eventual roll-off of the NBA contract – as key drivers of improved earnings resilience.

Under this framework, higher margins and stronger free cash flow help stabilize the business, but muted top-line growth and an elevated forward earnings multiple limit further upside at current prices.

A more constructive view from cash flow models

Not all valuation models agree that WBD’s rally has gone too far.

A discounted cash flow (DCF) analysis suggests a fair value closer to $28.98, implying the stock may still trade about 4% below intrinsic value. This more optimistic assessment assumes that improving cash flows — rather than headline revenue growth — will ultimately drive shareholder returns.

From this perspective, the rally may represent a delayed catch-up rather than an overshoot, particularly if management continues to prioritize deleveraging and capital discipline while stabilizing streaming economics.

Key risks remain beneath the surface

Despite the recovery narrative, several structural risks continue to shadow the investment case. Warner Bros. Discovery remains heavily reliant on tentpole franchises, while ongoing cord-cutting trends threaten the durability of its legacy television cash flows.

In addition, competition across streaming remains intense, and sustained pricing power is far from guaranteed. Any setback in subscriber growth, content execution, or advertising demand could quickly pressure margins and investor confidence.

Bottom line

Warner Bros. Discovery’s dramatic rebound has transformed sentiment around the stock, but valuation now sits at the center of the debate. While narrative-based models suggest the market may be pricing in much of the anticipated recovery, cash flow-focused analysis leaves room for modest upside if execution continues to improve.

For investors, WBD increasingly looks like a show-me story: further gains are likely to depend less on multiple expansion and more on consistent cash generation, debt reduction, and evidence that the streaming turnaround can be sustained.

At current levels, the stock appears closer to fair value than it has been in years — making selectivity and risk awareness more important than momentum alone.

Ready to start trading Forex? Join iXBroker today and kick-start your trading journey now!