Since returning to the White House in January, President Donald Trump has dismantled decades of US trade policy, erecting a broad tariff framework around what was once one of the world’s most open economies. His administration imposed double-digit import taxes on goods from nearly every country, sending shockwaves through global trade flows and corporate supply chains.

The tariffs have placed mounting pressure on household budgets and business costs worldwide, while simultaneously generating tens of billions of dollars in revenue for the US Treasury. Trump has defended the measures as necessary to reclaim wealth he argues was “stolen” from the US, narrow the long-standing trade deficit, and revive domestic manufacturing.

However, the disruption of global supply chains has contributed to higher consumer prices, and the administration’s shifting and unpredictable rollout of tariffs made 2025 one of the most volatile economic years in recent history.

Below is an overview of how Trump’s tariff policy has reshaped the US economy and global markets, illustrated through four key developments.

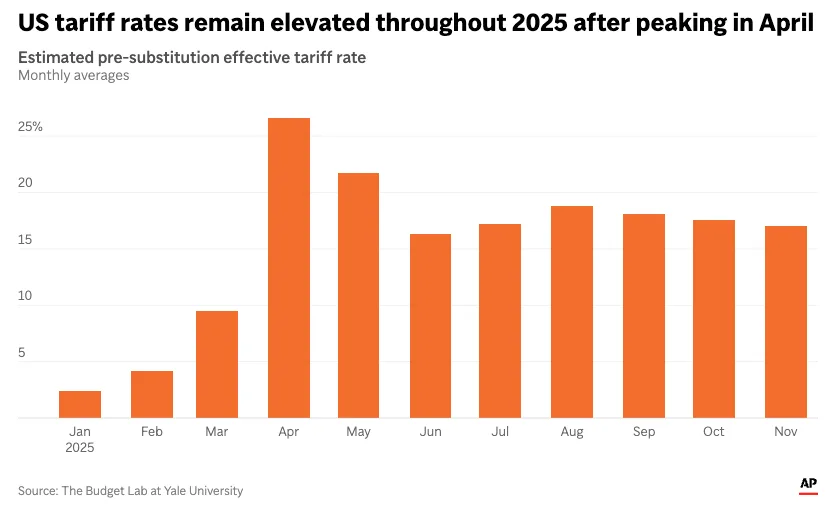

Effective US tariff rate remains historically elevated

One of the most accurate measures of tariff impact is the effective US tariff rate, which reflects the average duty applied to actual imports rather than headline tariff announcements tied to specific trade actions.

According to data from the Yale Budget Lab, the effective tariff rate peaked in April 2025 and has remained elevated throughout the year.

By November, before consumption patterns fully adjusted, the effective rate stood close to 17%, roughly seven times higher than the January average and the highest level recorded since 1935. This sustained increase underscores the broad and persistent burden placed on US consumers and businesses.

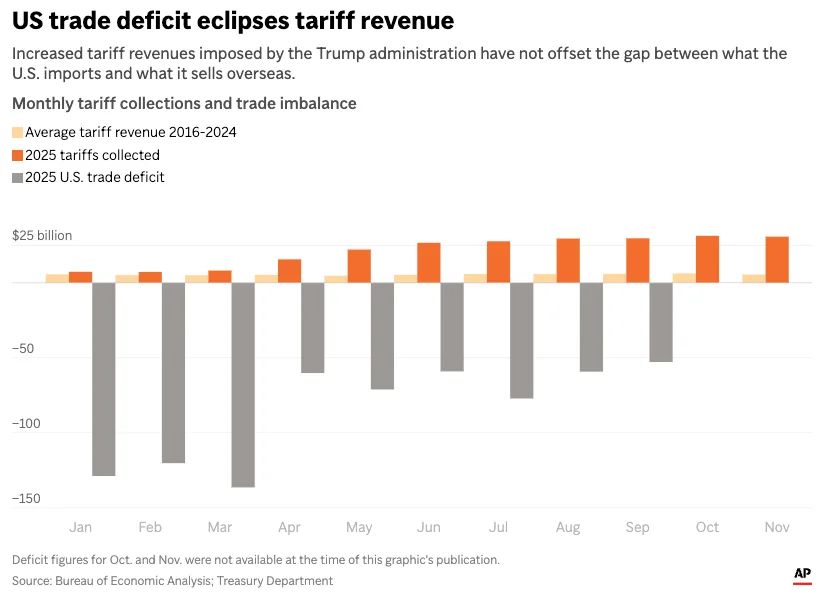

Tariff revenue trails America’s trade deficit

Trump has repeatedly pointed to tariff revenue as a key justification for his trade strategy, arguing that it could reduce the trade deficit while generating substantial government income.

Tariffs have indeed delivered a sharp rise in revenue, bringing in more than $236 billion through November, far exceeding collections from previous years. Despite this increase, tariff income still represents only a small share of total federal revenue and falls well short of supporting claims that it could replace income taxes or fund large-scale dividend payments to Americans.

Meanwhile, the US trade deficit has narrowed from earlier extremes. The deficit surged to a monthly record of $136.4 billion in March as firms rushed to import goods ahead of tariff hikes, before shrinking to $52.8 billion in September. Despite this improvement, the year-to-date deficit remains 17% higher than during the same period in 2024, highlighting the limits of tariffs as a corrective tool.

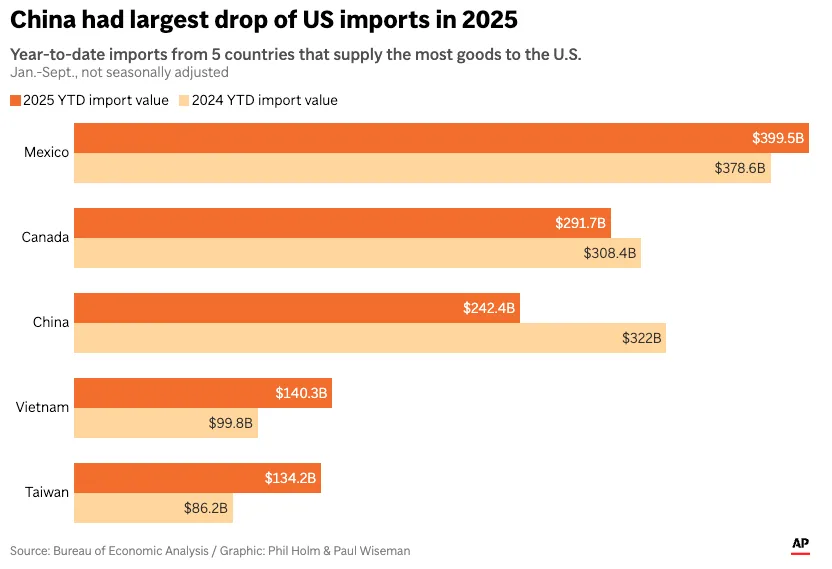

Import patterns shift among major trading partners

Trump’s tariff regime has affected nearly every US trading partner, but the most dramatic changes have occurred in trade with China. Once the largest source of US imports, China now ranks third behind Canada and Mexico.

Current US tariffs on Chinese goods stand at approximately 47.5%, according to estimates from the Peterson Institute for International Economics.

As a result, the value of US imports from China fell by nearly 25% during the first three quarters of the year. Imports from Canada also declined, while shipments from Mexico, Vietnam, and Taiwan increased on a year-to-date basis, reflecting a reconfiguration rather than a reduction of global supply chains.

Market volatility tracks tariff uncertainty

Financial markets experienced their sharpest swings during periods of heightened uncertainty surrounding Trump’s tariff decisions. For investors, abrupt policy announcements and reversals translated into increased volatility across equities.

The S&P 500 recorded its largest daily and weekly moves in April, coinciding with peak tariff tensions. The index also posted its steepest monthly decline in March and strongest monthly gain in June, underscoring how closely market sentiment tracked developments in US trade policy throughout 2025.

Ready to start trading Forex? Join iXBroker today and kick-start your trading journey now!