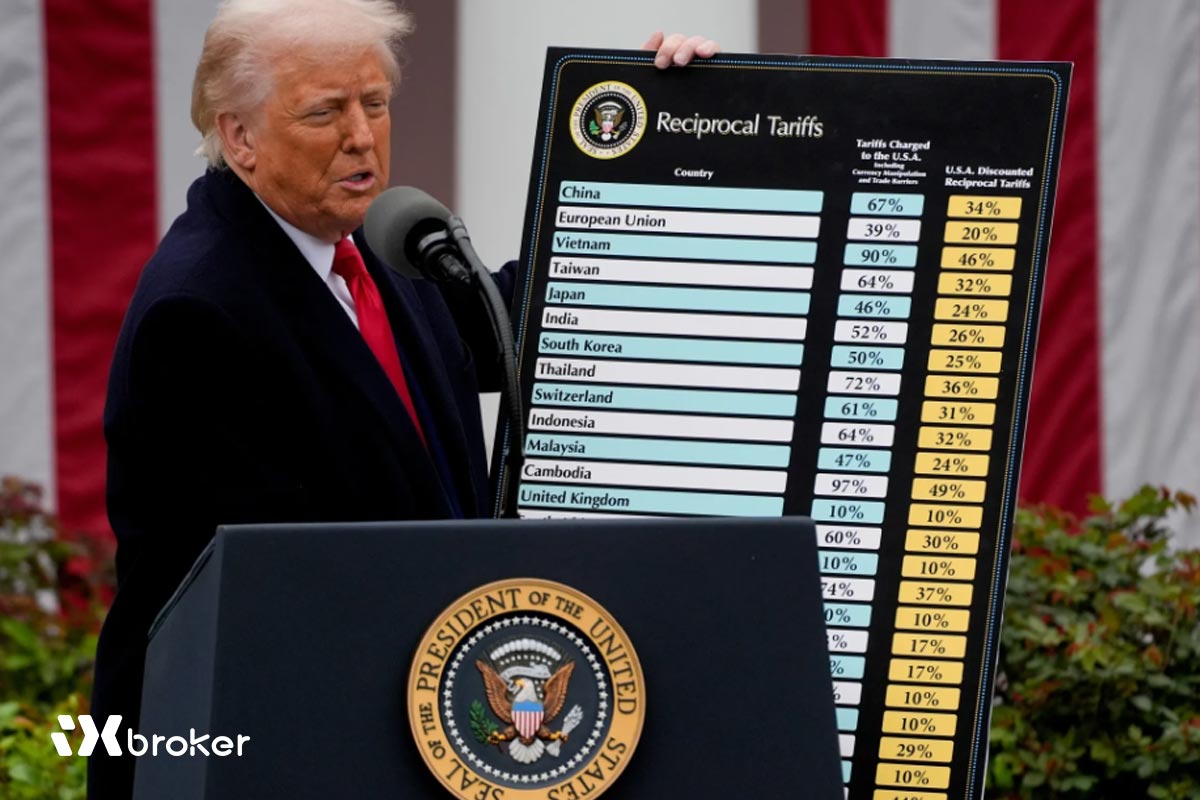

Global crypto markets tumbled sharply on Friday, Oct. 17, after U.S. President Donald Trump reaffirmed 100% tariffs on Chinese imports, a move that reignited fears of a prolonged trade war between the world’s two largest economies. Despite calling the tariffs “unsustainable,” Trump said they were necessary in response to China’s trade practices.

Crypto markets slump amid renewed trade tensions

The selloff hit the digital asset market hard, with Bitcoin dropping 5% in 24 hours and extending its weekly losses to 13%. The total cryptocurrency market capitalization fell 5.75%, while the top 20 crypto assets each declined around 5%.

The decline came as investors reacted to Trump’s comments defending the new tariffs. “It’s not sustainable, but that’s what the number is,” Trump said in a Friday interview. “They forced me to do that,” he added, blaming China for the escalating trade conflict.

Earlier in the week, Trump had struck a more optimistic tone about ongoing negotiations, confirming plans to meet Chinese President Xi Jinping in South Korea in two weeks for continued trade talks.

Trade war escalation rattles global markets

The renewed escalation follows China’s decision to expand export controls on rare earth minerals, which are crucial for U.S. industries — especially the technology and defense sectors. In response, the U.S. announced new tariffs and restrictions on software exports to China.

The tit-for-tat measures have raised global uncertainty and led to a broad selloff in risk assets. Analysts warn that a 100% U.S. tariff on Chinese goods could sharply increase inflation, reduce economic growth, and pressure employment in both countries.

Crypto reacts to macroeconomic stress

High-risk assets such as cryptocurrencies and tech stocks tend to suffer during periods of economic strain and monetary tightening. The latest tariff announcement triggered another round of capital flight from speculative markets.

Meanwhile, gold surged to a new record high, reaching $4,250 per ounce, as investors sought safety amid the growing trade and geopolitical tensions.