USD/JPY heads into a pivotal week dominated by the Federal Reserve. While Japanese yields have steered recent moves, that dynamic now takes a back seat to Wednesday’s FOMC decision. A 25bp cut is widely priced, but the real catalyst will be the statement, the vote split and the updated dot plot. With technical sending mixed signals, Powell’s tone may be the decisive factor shaping the next major swing in USD/JPY.

BoJ speculation is moving the Yen

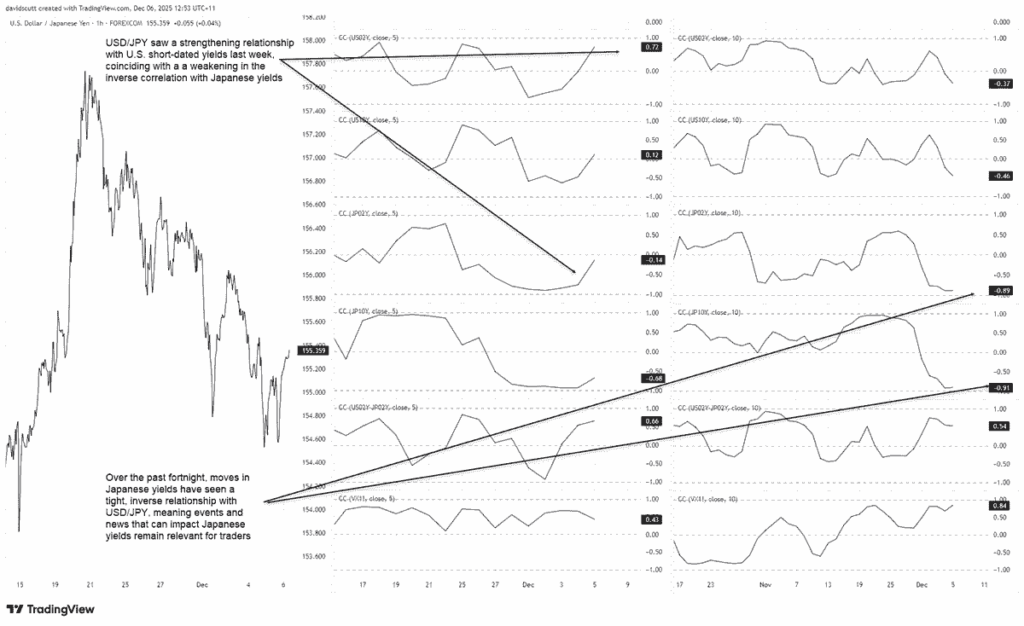

Recent five- and 10-day correlation readings show that USD/JPY has been far more sensitive to Japanese government bond yields than to U.S. rate expectations – a reversal of the usual pattern in which U.S. rates dominate directional bias.

For much of November, USD/JPY and Japanese yields were positively correlated. Rising yields – driven by expectations of increased fiscal spending – contributed to yen weakness amid concerns about financing Japan’s large debt burden. But in recent weeks, the relationship has flipped. With growing speculation that the BOJ may hike rates on 19 December, higher JGB yields are now strengthening the yen.

Correlation coefficients between USD/JPY and Japanese two- and 10-year yields currently sit at -0.89 and -0.91, far stronger than correlations with U.S. yields, spreads or volatility benchmarks like VIX futures. For traders, that means this week isn’t just about the Fed – any event that moves JGB yields may influence USD/JPY.

But the Fed may flip the script

While the yen–JGB relationship remains intact, the correlation softened late last week as USD/JPY began tracking short-end U.S. rates more closely—rates heavily influenced by Fed expectations. On Friday, markets pared rate-cut bets for the end of next year to around 78.5bp from more than 90bp at the start of December. That shift coincided with a meaningful bounce in USD/JPY, underscoring that Wednesday’s FOMC meeting is the week’s defining catalyst.

Dots, dissents and Powell

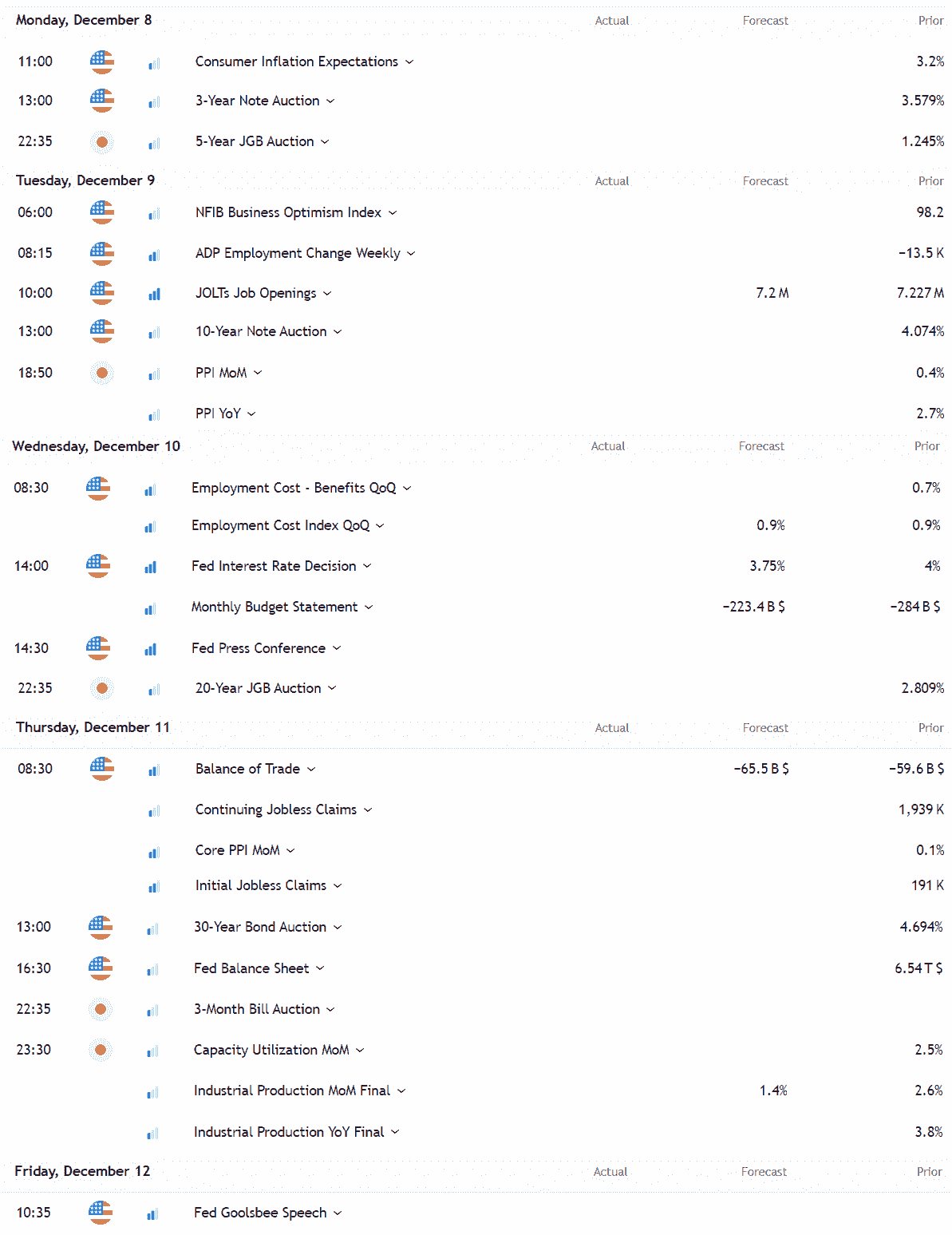

Unless the Fed surprises by deviating from the consensus call for a 25bp cut to 3.5–3.75%, the market reaction—and USD/JPY direction—will hinge on forward guidance.

The statement language and the vote split will offer early clues. Stephen Miran is again expected to dissent in favor of a 50bp cut, so the focus will be on how many members argue for no change. With the committee split between inflation hawks and labor-market doves, any clustering of votes will speak volumes. A broad majority supporting a 25bp reduction could reinforce expectations for further easing in 2025, likely weighing on USD/JPY.

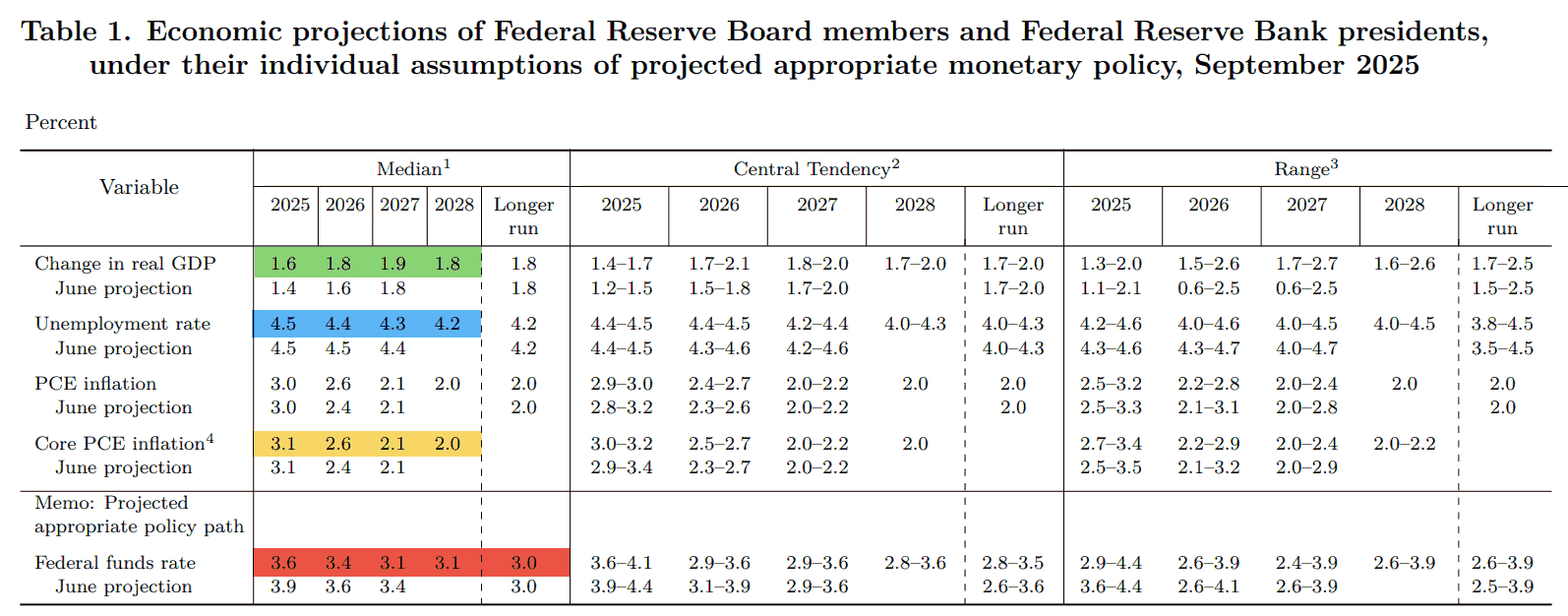

Markets will then move to the dot plot. Three months ago, the median projection pointed to two more cuts in 2025 and one each in 2026 and 2027. If the Fed delivers its third cut of the year this week, it may raise the risk of fewer cuts being signaled for 2026–27—fueling expectations of a “hawkish cut.” Conversely, if the medium-term dots stay unchanged or drift lower, particularly the long-run neutral rate estimate, markets may interpret the move as dovish, pressuring the U.S. dollar.

Updated projections for GDP, unemployment and core PCE will draw attention, but historically it’s the dots that deliver the strongest market signal.

Bond auctions, jobs data create event risk

Outside the FOMC, U.S. labor-market data carries the greatest potential to jolt USD/JPY. JOLTS, ADP, employment cost data and jobless claims will all matter—weak data risks a softer USD and vice versa. Treasury auctions in the three-, 10- and 30-year tenors, along with a 20-year JGB auction, may also influence the pair given the strong sensitivity to outright yields. Recent JGB auctions have seen stronger demand when yields rise, providing near-term support for the yen.

USD/JPY technical outlook: neutral bias amid mixed signals

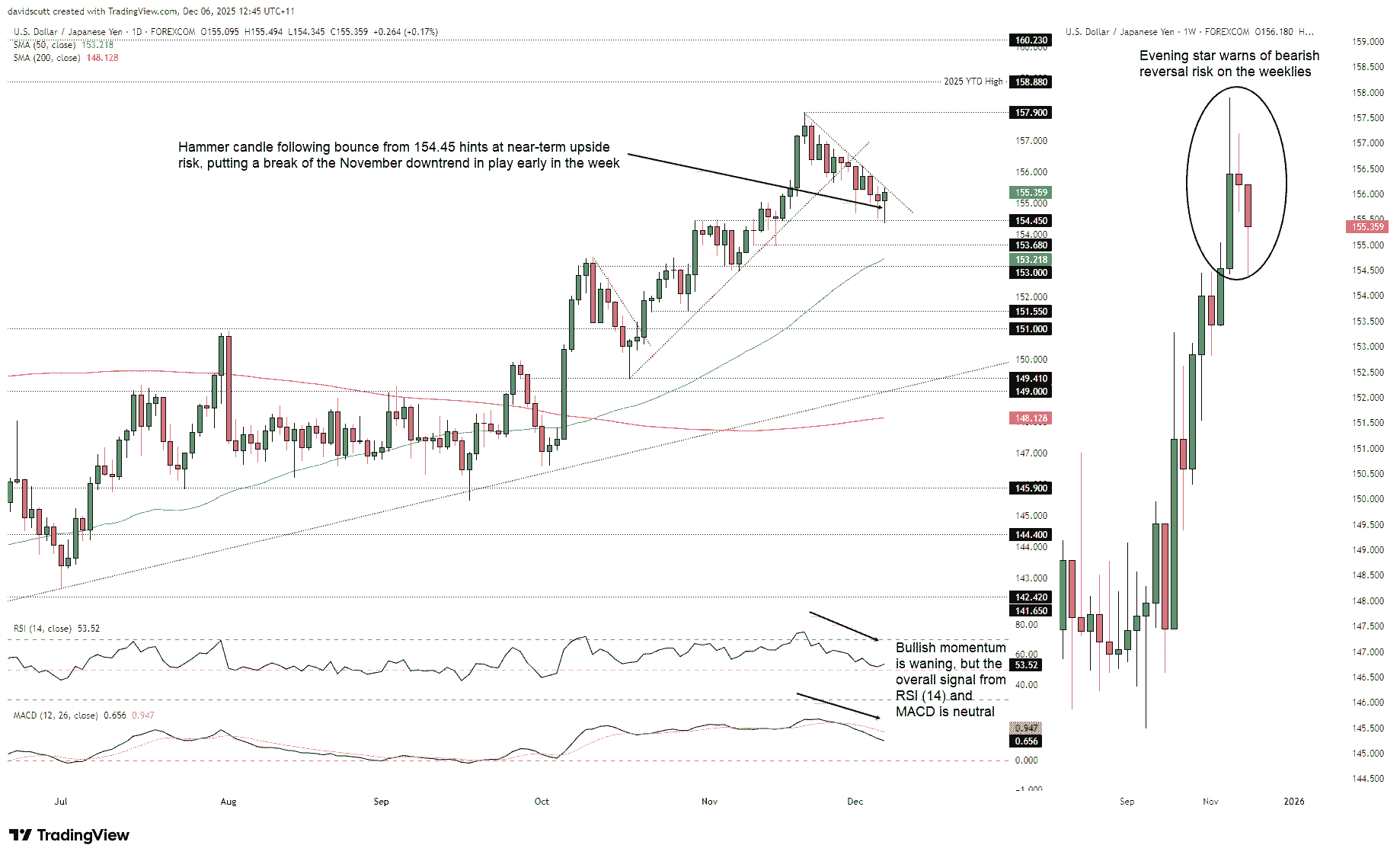

Technical signals remain conflicted. The weekly chart’s evening star bearish reversal pattern is partly offset by Friday’s hammer candle, highlighting short-term upside risks and the potential for a break above the recent downtrend.

RSI (14) sits near neutral and MACD has crossed below its signal line, signaling fading upside momentum. Overall, directional bias is neutral, placing greater emphasis on price action.

Key resistance sits at the November swing high of 157.90, with bulls eyeing a retest of the 2025 high at 158.88 if that level breaks. On the downside, a move below 154.45 exposes 153.68, followed by stronger support near 153.00. Traders should also watch the 50DMA, though USD/JPY tends to react more to the 200-day average. A dovish Fed could push the pair toward 151.55 and 151.00.

Ready to start trading Forex? Join iXBroker today and kick-start your trading journey now!