Introduction

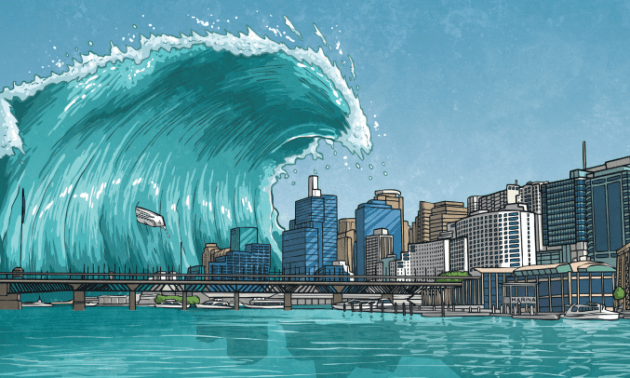

The financial markets are shaped by forces both rational and unpredictable. Among the least predictable are natural disasters—typhoons, earthquakes, floods, and other catastrophic events that, in a matter of hours or days, can shake economies, industries, and investor sentiment to the core. For traders, particularly those involved in sensitive sectors like aviation, hospitality, or tourism, understanding how these shocks filter through to stock prices is not just academic—it’s essential for survival and success.

Drawing on empirical findings from the Chinese market, this article gives you an actionable framework for trading and risk management when facing the fallout from natural disasters. We’ll dissect the mechanisms—crash risk, investor sentiment, firm size, and market competition—and connect them to practical strategies and psychological resiliency. Whether you’re a seasoned trader or aspiring to join the ranks, these insights will help you anticipate, react, and adapt in today’s volatile world.

Why Natural Disasters Matter to Traders

Natural disasters have become more frequent and severe in recent years—a phenomenon almost all asset classes must price in eventually. However, aviation, hospitality, and tourism companies are uniquely exposed. Their revenues rely heavily on logistics, infrastructure, and consumer demand, making them particularly vulnerable to disruptions.

When disaster strikes—say a typhoon disrupts air travel, or an earthquake reduces tourist numbers—revenues plummet overnight. This triggers not just short-term shocks to profits, but also uncertainty about long-term viability, spooking investors and amplifying price swings.

Key Trading Insight:

Recognizing the vulnerability of certain sectors during natural disasters gives alert traders a key advantage. Patterns of abrupt sell-offs, volatility spikes, and sentiment-driven swings can point to tactical opportunities (both risk and reward), but only if you can anticipate the causal chains.

The Mechanics: How Natural Disasters Impact Stock Prices

Natural disasters do not just cause physical losses. They ripple through companies’ supply chains, affecting costs, market share, and reputation. In high-competition environments—where price wars and slim margins are already the norm—even a temporary disruption can create existential risks for smaller players.

For traders, three layers of impact are crucial:

- Direct Operational Losses

Damaged assets and shut businesses mean sudden drops in cash flow and profitability.

- Supply Chain & Demand Disruptions

Even companies physically distant from disaster zones may suffer due to broken supply lines, declining tourist arrivals, or logistics jams.

- Investor Perception and Sentiment

The market isn’t just weighing numbers, but stories and emotions: Will this company recover? Is there more pain ahead?

In a fog of uncertainty, investors often overreact.

Personalized Tip:

Monitor not just company news, but macro-level updates from weather bureaus, tourism agencies, and regional governments. Markets often lag behind these developments, rewarding those who connect the dots ahead of the crowd.

Trading through Crash Risk: The Hidden Nemesis

One of the study’s most actionable findings is the role of crash risk—the probability of sharp, one-sided declines in stock prices (the “left tail” everyone dreads).

Natural disasters reliably increase this risk, particularly for companies that:

- Are smaller, less diversified, and financially leveraged.

- Operate in highly competitive markets with little pricing power.

How Crash Risk Manifests:

- Negative skewness: Sudden disasters create a statistical tendency for large negative returns, even if the average trend seems benign.

- Volatility Skew: Downside volatility outpaces upside potential, shrinking the reward-risk ratio for bullish trades.

As a trader, treating crash risk as a tangible hazard is non-negotiable. Use options for hedging if possible, trim leverage in exposed stocks, and whenever a disaster looms, employ wider stop losses and reduce position sizing.

Advanced Note:

Real pros will measure crash risk using tools like NCSKEW (negative skewness coefficient) or DUVOL (down-to-up volatility ratio)—metrics that, while academic, translate into practical strategies: when these spike, beware of “picking up pennies in front of a steamroller.”

The Power (and Peril) of Investor Sentiment

Market psychology becomes dramatically more important during disasters. The study highlights a crucial finding: Investor sentiment can either cushion or amplify the negative impact of calamity.

- In optimistic climates, investors are more likely to “look through” temporary chaos, creating buying opportunities on exaggerated dips.

- Conversely, when pessimism is entrenched, even small shocks can become cascades, driving prices unaffordably low.

Practical Takeaways:

- Gauge market sentiment before entering disaster-exposed trades. Look at news flow, social media, and even implied volatility in options markets.

- Avoid contrarian trades in environments where sentiment is deteriorating and risk of panic selling is high.

Trading Wisdom:

Just as not all disasters cause panics, not all panics are rational. When you spot mismatches—where fundamentals are resilient, but sentiment is overly grim—there may be outsized opportunities. Use smaller probe positions to test your thesis before committing.

Small vs. Large Caps: Not All Companies Are Equal

Another actionable lesson from the research is the uneven impact of disasters:

- Small and Medium Enterprises (SMEs):

Tend to suffer most due to limited resources, risk buffers, and weaker brand loyalty. For traders, these stocks often exhibit higher beta (volatility) and sharper sell-offs—sometimes overdone.

- Large, Diversified Firms:

While still affected, they typically rebound faster and attract “flight to quality” capital in post-disaster recoveries.

Actionable Approach:

If trading post-disaster, use firm size and balance sheet strength as a filter. Defensive plays focus on quality; aggressive, risk-tolerant trades may target oversold small caps for bounce potentials—if signs of stabilization emerge.

Market Competition: The Double-Edged Sword

Competition can be a blessing or a curse for disaster-exposed sectors. In cutthroat markets, there’s little room for error—companies without pricing power or deep pockets are the first to falter.

Trading Angle:

Sector-wide sell-offs may mask differentiated risk profiles between competitors. Deep research—comparing margins, debt loads, and historical crisis resilience—lets you cherry-pick potential survivors or short likely casualties. Stay flexible; today’s laggard can become tomorrow’s winner if competitive dynamics shift post-crisis.

Policy and Macro Factors: The Bigger Picture

Don’t overlook the role of government intervention and macro policy:

- Disaster relief, stimulus packages, and regulatory flexibilities can reshape recovery trajectories.

- For aviation and hospitality, travel bans, insurance payouts, or recovery incentives may all trigger sharp market reversals.

Trader’s Checklist:

- Stay alert to policy announcements from relevant ministries/agencies.

- Consider FX volatility if companies are exposed to cross-border revenues and costs.

- Don’t ignore global spillovers—a disaster in one region can disrupt supply and demand chains worldwide.

The Psychology of Trading Disasters

Beyond numbers and headlines, disaster-driven markets test your temperament. Volatility, fear, and rumors can provoke impulsive decisions.

Professional Habits:

- Journal your trades: Record not just what you did, but why—were you responding to facts or feelings?

- Define risk ahead of time: Calculate stop losses and stick to them.

- Maintain perspective: Disasters, by definition, are rare and acute. Don’t extrapolate chaos forever, but likewise, don’t assume a quick return to normal.

Pro Tip:

Take scheduled breaks from the screens. In disaster-driven markets, emotional contagion is real—don’t let short-term noise crowd out long-term discipline.

Learning from History: Case Examples

- Pandemics:

COVID-19 induced record single-day declines in travel, yet airlines and hotels with strong liquidity rebounded as vaccines rolled out and travel restrictions eased.

- Natural Catastrophes:

Major earthquakes or typhoons historically crush region-specific stocks, but often create asymmetric rebounds when government rescue and insurance flows arrive.

- Behavioral Spirals:

After major shocks, clusters of retail investors may either “panic sell” good assets or chase rebounds prematurely. Professionals use these behavioral surges as liquidity events—either to unwind risky exposure at reasonable prices, or to build positions for long-term recovery.

Action Checklist for Disaster-Aware Traders

- Map Your Sector Exposure:Know which of your holdings are levered to disaster-prone regions and industries.

- Monitor Real-Time Risk Indicators:Not only prices, but skewness, options volatility, and news sentiment.

- Diversify Trading Strategies:Combine defensive tactics (cash, hedges) with tactical offense (contrarian picks) as conditions evolve.

- Stay Liquid:In highly illiquid moments, survival is easier for those who can wait things out.

- Learn and Adapt:Every crisis brings new lessons in crisis management, crowd psychology, and risk calibration.

Conclusion: Turning Turmoil into Trading Edge

Navigating natural disaster risk isn’t just about avoiding losses—it’s about harvesting the opportunities that turbulent markets provide to the prepared. The key is a dynamic blend of fundamental research, sentiment analysis, risk discipline, and psychological steadiness.

The aviation, hospitality, and tourism sectors offer a vivid laboratory for these principles. When the skies darken—literally or figuratively—those who have planned, diversified, and maintained a cool head often emerge in a stronger position.

For traders on iXbroker and beyond, the message is clear: Don’t fear uncertainty. Understand it, quantify it, and let it work for you.