Ethereum spot ETFs saw $75.21 million in outflows on December 5, with all nine funds reporting zero inflows as ETH continued to trade sideways near the $3,000 level. BlackRock’s ETHA accounted for the entire withdrawal, marking the fourth straight day of redemptions for Ethereum ETFs. ETH was trading at $3,030, within a 24-hour range of $2,995.50 to $3,146.10. The token has fallen 2.7% over the past 24 hours and 10.3% over the past month.

Blackrock drives fourth straight day of redemptions

Ethereum ETFs have been consistently shedding capital since December 2, posting daily outflows of $79.06 million, $9.91 million, and $41.57 million before Thursday’s additional $75.21 million. December 3 was the only exception, when the category briefly recorded $140.16 million in inflows, led by Fidelity’s FETH.

BlackRock’s ETHA remains the largest Ethereum ETF, with $13.09 billion in cumulative net inflows. Grayscale’s ETHE, by contrast, has registered -$4.99 billion in net outflows since its conversion from a trust structure. Fidelity’s FETH continues to grow steadily with $2.62 billion in total inflows.

Total Ethereum ETF assets under management reached $18.94 billion as of December 5, with cumulative net inflows across all funds sitting at $12.88 billion. Total value traded on December 5 rose to $1.77 billion, up slightly from the previous day’s $1.75 billion.

Meanwhile, Bitcoin ETFs recorded $54.79 million in inflows on the same day, pushing their total net assets to $117.11 billion and cumulative inflows to $57.62 billion.

Exchange supply hits new record low

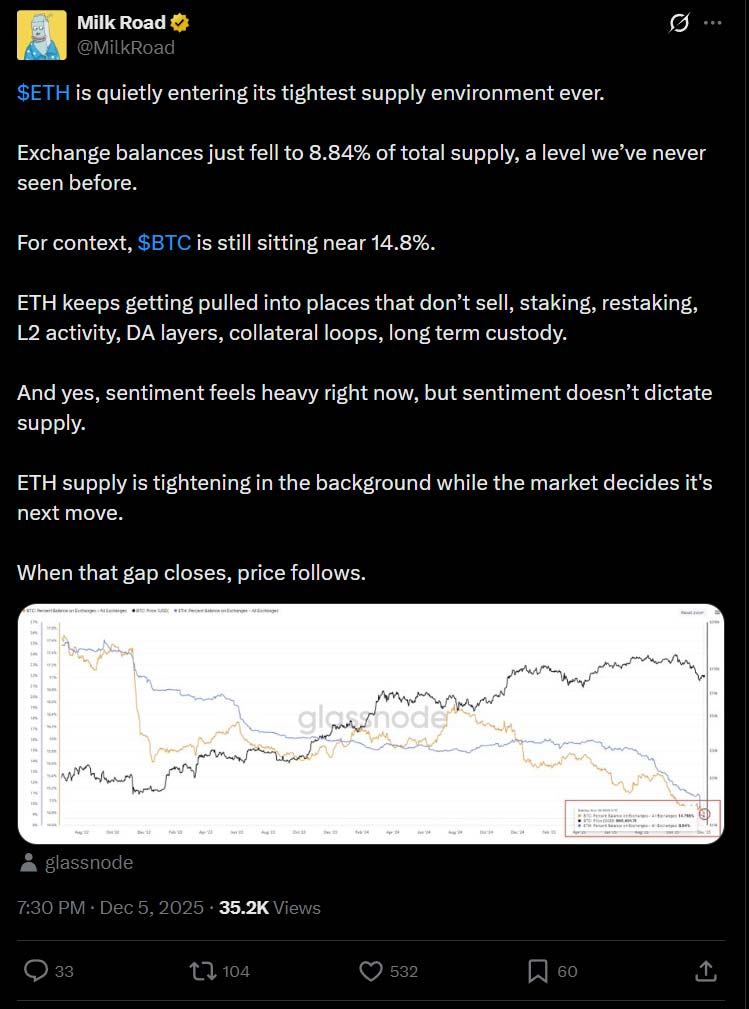

Ethereum’s exchange balances dropped to 8.84% of total supply, the lowest level ever recorded. By comparison, Bitcoin’s exchange balance stands at 14.8%, highlighting a substantially tighter circulating supply for ETH.

Market watchers note that despite the bearish sentiment, on-chain dynamics are strengthening. “ETH keeps getting pulled into places that don’t sell: staking, restaking, L2 activity, DA layers, collateral loops, long-term custody,” Milk Road wrote on X. The post emphasized that market mood does not alter structural supply constraints.

“ETH supply is tightening in the background while the market decides its next move. When that gap closes, price follows,” the account added.

Ready to start trading Forex? Join iXBroker today and kick-start your trading journey now!