The Dow Jones Industrial Average (DJIA) surged to a fresh record on Thursday as investors rotated out of pressured tech names and into stocks more closely tied to economic growth following the Federal Reserve’s (Fed) latest interest rate cut. Visa (V) helped lead the Dow higher after an analyst upgrade, while the S&P 500 traded near flat and the Nasdaq slipped as traders digested a sharp reversal in major tech stocks.

Tech stocks slump as AI names come under pressure

Oracle (ORCL) posted disappointing revenue results alongside a higher spending outlook and sharply negative free cash flow, sparking concerns about the ability of large AI investments to deliver near-term profitability. Shares fell 12%, weighing on the broader tech sector and dragging other AI-linked names lower. Several analysts cut price targets and warned of heightened uncertainty regarding Oracle’s trajectory.

Lower interest rates, meanwhile, boosted cyclical sectors and small-cap stocks, sending the Russell 2000 to an intraday record alongside the Dow. Investors also discussed the potential for a year-end “Santa Claus rally,” though some strategists highlighted possible headwinds for 2025–2026, including AI fatigue, political transitions, and an upcoming change in Fed leadership.

Macro data secondary as fed cut dominates sentiment

Jobless claims rose sharply in the aftermath of the holiday period, though continuing claims declined significantly, signaling some stabilization in longer-term unemployment. On the corporate front, OpenAI introduced its latest GPT-5.2 model with enhanced productivity features. Rivian announced it is developing an in-house AI chip to reduce dependency on Nvidia and advance its autonomous-driving strategy.

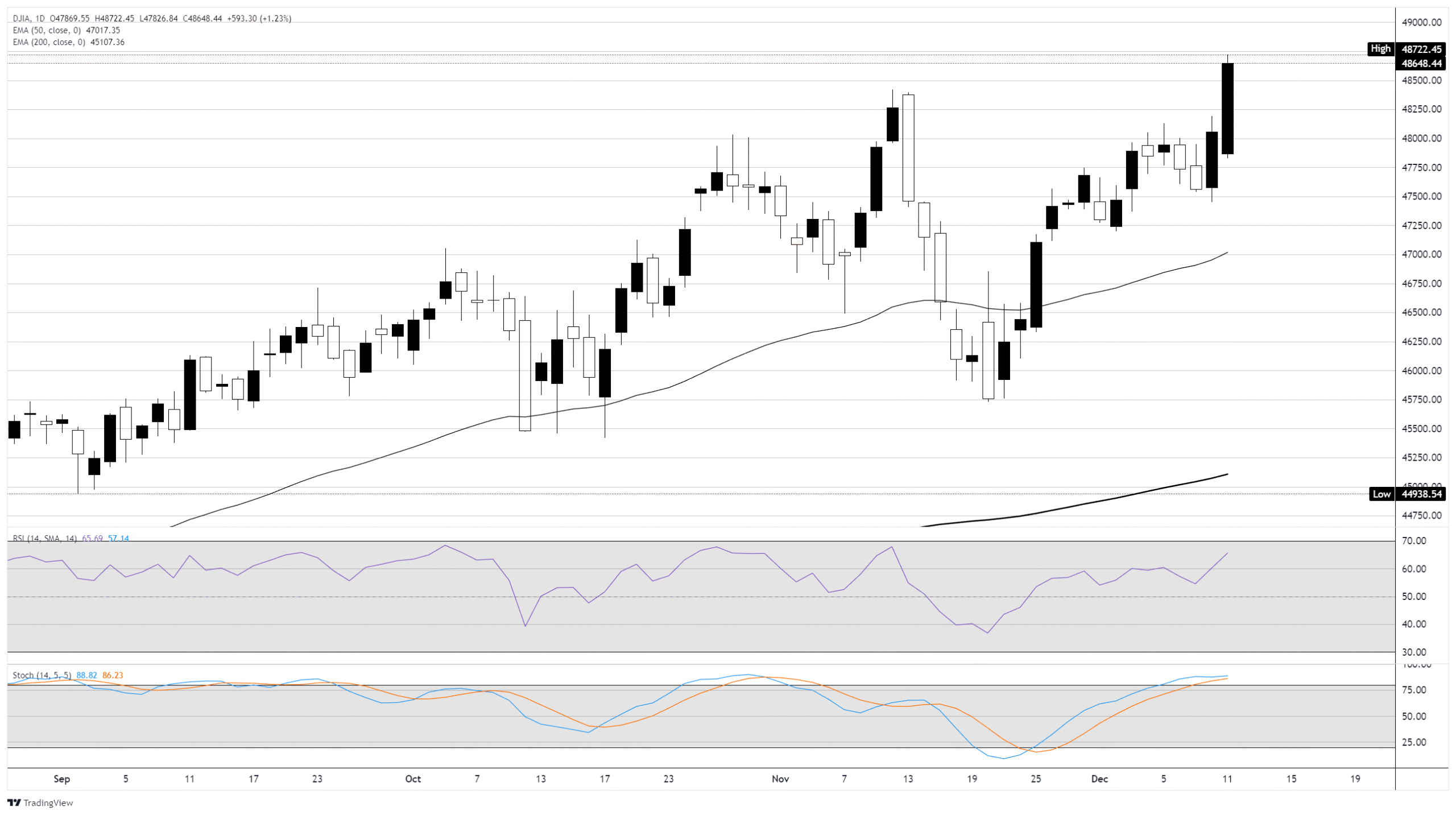

Technical outlook: Dow extends record-breaking momentum

The Dow Jones daily chart shows continued strength as the index pushes deeper into record territory. Momentum remains constructive, supported by rotation flows and improved sentiment across value and growth-cyclical sectors.

Ready to start trading Forex? Join iXBroker today and kick-start your trading journey now!