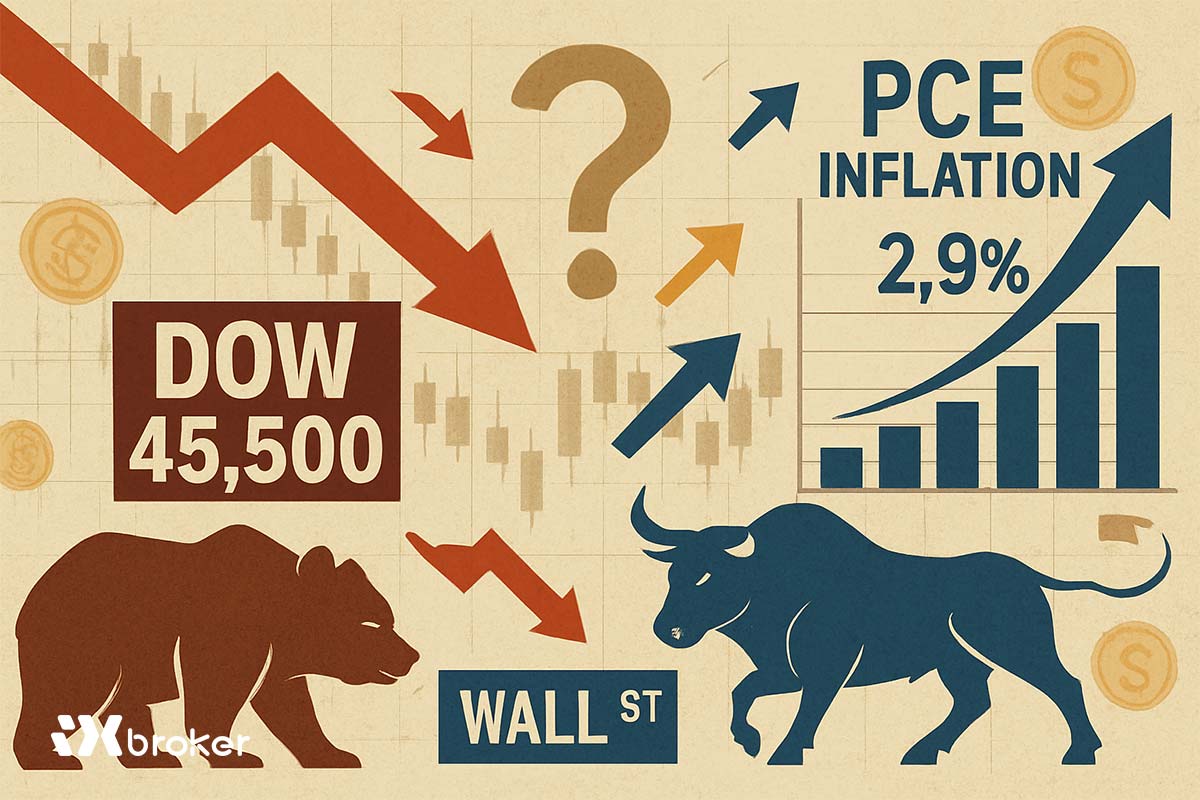

The Dow Jones Industrial Average (DJIA) slipped on Friday, retreating below the 45,500 mark as investors reacted to a fresh rise in US Personal Consumption Expenditures (PCE) inflation. Despite mounting inflationary pressures, markets remain firmly positioned for the Federal Reserve (Fed) to deliver a rate cut in September.

Equities pull back but maintain resilience

Although the Dow closed lower, the index continues to hold onto recent gains and sits just shy of record highs above 45,760. While bullish momentum has cooled in the near term, intraday support remains evident around the 45,500 level, signaling that downside moves are still limited.

Core PCE inflation accelerated to 2.9% year-over-year in July, marking the highest reading since March. The uptick highlights the persistence of tariff-driven price pressures, effectively undoing several months of progress in the Fed’s inflation battle.

Fed rate cut expectations remain strong

Market participants are still betting heavily on monetary easing. According to the CME FedWatch Tool, traders are pricing in nearly a 90% probability that the Federal Open Market Committee (FOMC) will lower rates by a quarter point when it meets on September 17.

The Fed faces a growing dilemma: inflation remains above its 2% target, yet weakening labor market conditions may force policymakers’ hand. Employment data has already shown notable deterioration in the second quarter, and further weakness in upcoming reports could intensify pressure on the Fed to act sooner rather than later. The next key employment release is due late next week and will be closely watched for policy implications.