The crypto market extended its recent upward momentum, with Bitcoin and most major altcoins trading in the green as key market metrics surged.

Bitcoin jumped to $92,500, up nearly 15% from its November low. Ethereum remained comfortably above the $3,000 resistance level, while total cryptocurrency market capitalization exceeded $3.25 trillion, highlighting broad-based gains across the sector.

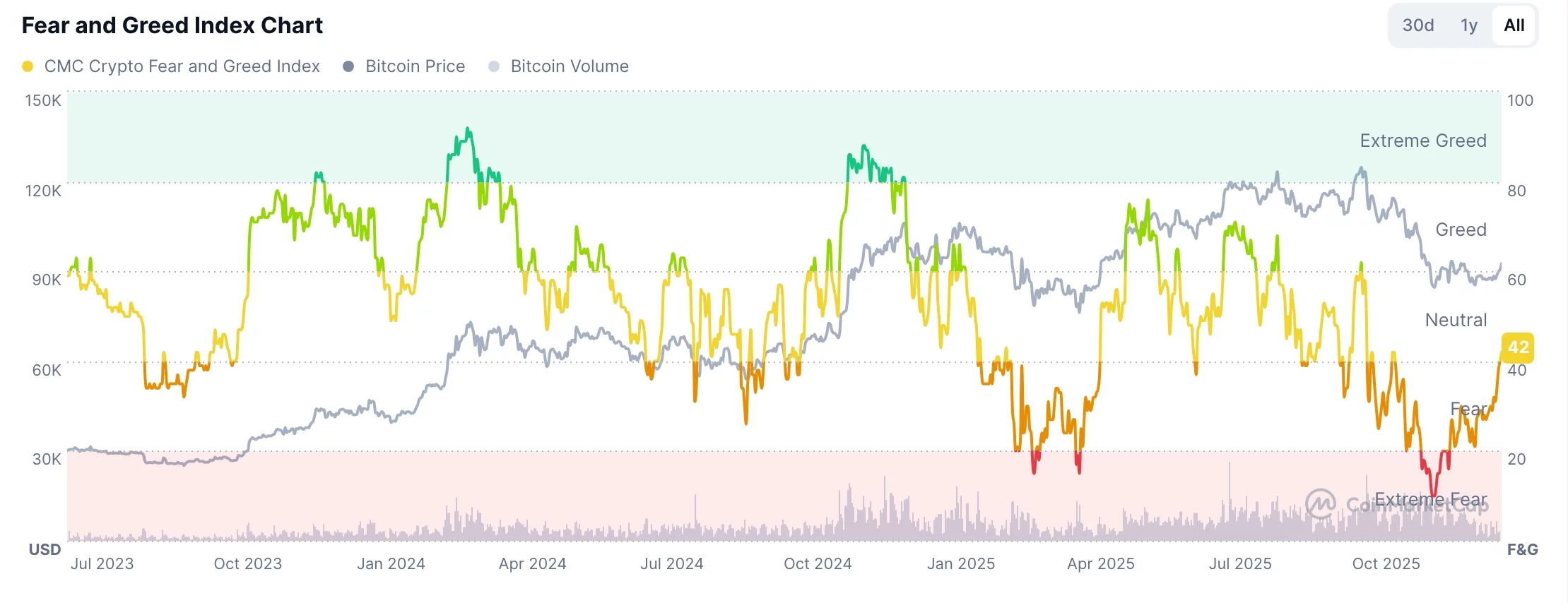

Fear and greed index signals improving sentiment

The ongoing rally coincided with the Crypto Fear and Greed Index moving out of the extreme fear zone. Data from CoinMarketCap show the index rising from a November low of 10 to 42, reaching its highest level since September.

The index evaluates market sentiment using multiple indicators, including price momentum of Bitcoin and altcoins, market volatility, derivatives activity, and Bitcoin’s relative market value. Modeled after CNN Money’s stock market gauge, it tracks stock price strength, breadth, options activity, and volatility. The index has surged from extreme fear of 5 in November to 45, signaling growing bullish sentiment among investors.

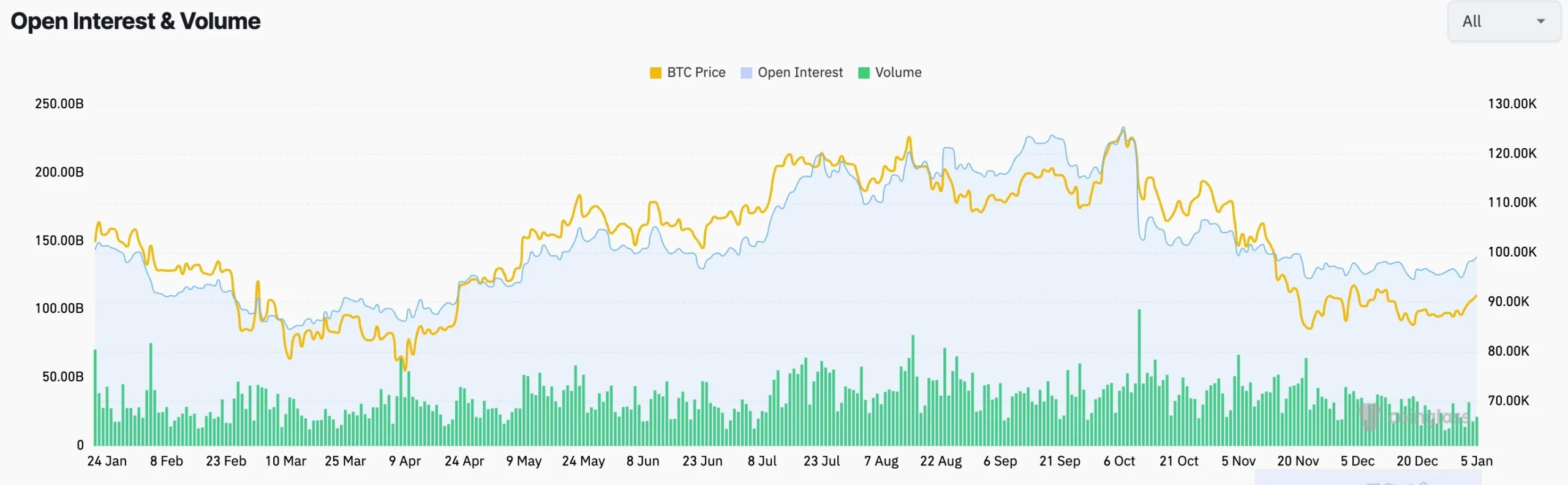

Futures open interest rebounds

The crypto rally is also supported by rising futures open interest. CoinGlass data show that total futures open interest climbed 1.433% over the past 24 hours to over $140 billion, marking the highest level in more than a month.

Increasing open interest is considered bullish, as it suggests investors are using leverage to amplify their positions. Leverage typically contributes to larger price swings and can fuel further upside. Open interest had been in a downward trend following October 10 events, when over 1.6 million traders were liquidated, losing more than $20 billion amid concerns over potential tariffs announced by former US President Donald Trump.

Ready to start trading Forex? Join iXBroker today and kick-start your trading journey now!