Stocks finished Friday’s session near all-time highs, with the S&P 500 hovering just below 6,900 as a jittery bond market braces for what comes next. Investors face a packed agenda this week, led by the final Fed meeting and Chair Jerome Powell’s last press conference of 2025. On the corporate front, all eyes are on Wednesday’s results from Oracle (ORCL) and Adobe (ADBE), followed by earnings from Broadcom (AVGO) and Costco (COST) on Thursday.

The economic schedule keeps the focus on labor conditions, with delayed October JOLTS data set for release Tuesday, providing fresh insight into hiring, separations, and quits.

Welcome to Fed week

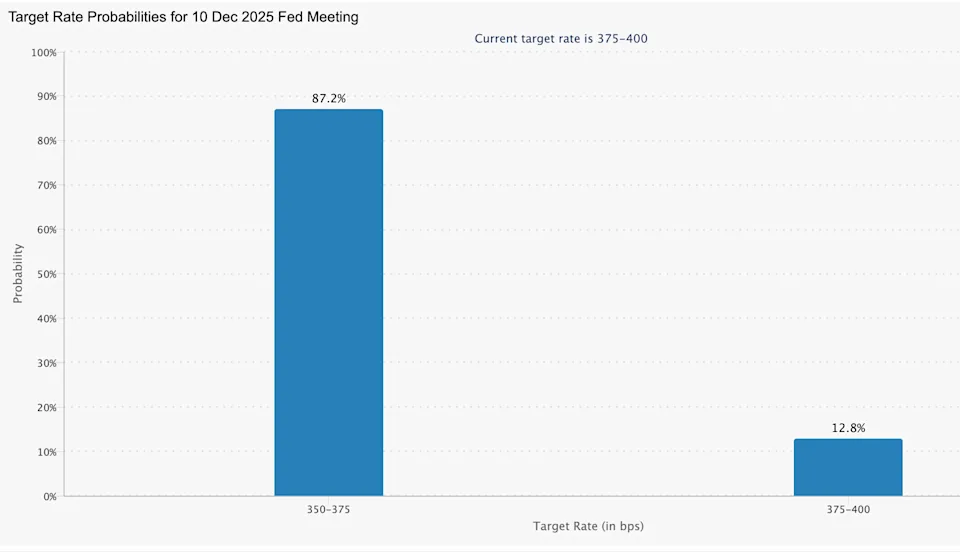

The Federal Reserve’s rate-setting committee reconvenes Tuesday, with markets waiting for Wednesday’s policy announcement and Powell’s Q&A – a key moment for hints on the central bank’s 2026 trajectory. Recent employment data revealed cracks in the labor market, with ADP and Challenger reports showing unexpected job losses and elevated layoffs. This has fueled near-unanimous market conviction that a 25-basis-point rate cut is coming, shifting the target range from 3.75%–4.00% down to 3.50%–3.75%.

Friday’s PCE inflation reading, showing further cooling in September, reinforced those expectations. Still, the Fed’s messaging often holds surprises even when the policy outcome seems assured.

Investors will closely parse Powell’s press conference at 2:30 p.m. ET on Wednesday, as market reactions tend to hinge more on his tone than the 2 p.m. statement. The final Summary of Economic Projections – the so-called “dot plot” – will also offer a window into policymakers’ expectations for growth, inflation, and rates in the year ahead.

This meeting also marks the final vote for the current rotation of regional Fed presidents before Cleveland, Minneapolis, Dallas, and Philadelphia take their seats. Meanwhile, speculation over Powell’s successor has intensified, with President Trump pledging to name a nominee early next year. Kevin Hassett, Trump’s top economic adviser, is viewed as the leading contender, though his potential appointment has stirred discomfort in the bond market.

The Fed’s job is complicated by patchy data: post-shutdown disruptions have delayed or distorted key reports, meaning policymakers are working with incomplete visibility.

Watching for a Santa Claus rally

Stocks ended last week higher as investors looked ahead to a probable rate cut. But despite record-setting levels, the early signs of a potential “Santa Claus rally” may be threatened, according to Bank of America strategist Michael Hartnett. Investors want the perfect trifecta – lower rates, a resilient economy, and moderating inflation. Hartnett warns that a dovish cut could unsettle markets by driving bond yields higher and stocks lower.

This makes Powell’s tone – and the Fed’s economic projections – even more critical.

The bond market is nervous

Bond markets remain on edge, with the 10-year yield climbing more than 10 basis points on Friday, capping one of its roughest weeks in months. Even with Friday’s inflation report cementing expectations for a December cut, the still-elevated price pressures cloud the outlook for additional easing in 2026.

Markets appear increasingly skeptical that a new Fed chair – even someone favored by Trump – can deliver rapid rate reductions. With inflation data overshadowing earlier signs of labor market weakness, Wednesday’s meeting becomes even more consequential. More clarity is expected on Dec. 16 when November’s jobs report is finally released.

Bitcoin watch

Bitcoin (BTC-USD) has partly lived up to its “digital gold” label this year as dollar outflows occasionally flowed into crypto – though physical gold (GC=F), up nearly 60%, has outshined it. Despite critics’ concerns, bitcoin has held a relatively stable range between $75,000 and $120,000 through 2025.

Still, bitcoin’s long-term behavior diverges from gold: it tends to trade like a high-beta risk asset, rising with tech stocks and speculative themes and retreating when sentiment cools. But 2025 marks a rare break in that pattern. While the S&P 500 (^GSPC) has gained more than 16%, bitcoin remains in the red, creating one of the widest performance gaps between the two since 2014. After another volatile Friday session, bitcoin stays on the watchlist this week.

Economic and earnings calendar

Monday

Economic data: New York Fed 1-yr inflation expectations, November (3.24% previously)

Earnings: Toll Brothers (TOL), The Children’s Place (PLCE)

Tuesday

Economic data: BLS releases Sept. & Oct. JOLTS data; NFIB small business optimism, November (98.2 previously); JOLTS job openings, October; JOLTS job openings rate, October; JOLTS quits level, October; JOLTS quits rate; JOLTS layoffs level, October; JOLTS layoffs rate, October

Earnings: AutoZone (AZO), Ferguson Enterprises (FERG), Casey’s General Stores (CASY), SailPoint (SAIL), GameStop (GME), Campbell’s (CPB), Ollie’s Bargain Outlet (OLLI), Braze (BRZE), Cracker Barrel (CBRL), Dave & Buster’s (PLAY)

Wednesday

Economic data: FOMC rate decision; MBA mortgage applications, week ended Dec. 5 (-1.4% previously); Employment cost index, Q3 (0.9% expected, 0.9% previously); Federal budget balance, November (-$284.4B previously)

Earnings: Oracle (ORCL), Adobe (ADBE), Synopsys (SNPS), Chewy (CHWY), Nordson (NDSN), Uranium Energy (UEC), Vail Resorts (MTN), Planet Labs (PL), REV Group (REVG)

Thursday

Economic data: Initial jobless claims, week ended Dec. 6; Continuing claims, week ended Nov. 29; Wholesale inventories, September final; Wholesale trade sales, September (0.1% previously)

Earnings: Broadcom (AVGO), Costco (COST), Lululemon (LULU), Netskope (NTSK), National Beverage (FIZZ), RH (RH), Vizsla Silver (VZLA), Uranium Royalty (UROY)

Friday

Economic data: No major releases

Earnings: Rent the Runway (RENT)

Ready to start trading Forex? Join iXBroker today and kick-start your trading journey now!