President Donald Trump said on Saturday that the United States would move to take control of Venezuela’s vast oil reserves and invite major American energy companies to invest billions of dollars in rebuilding the country’s severely damaged oil industry. The announcement places Venezuela’s energy future — and its impact on global oil markets — firmly back in focus.

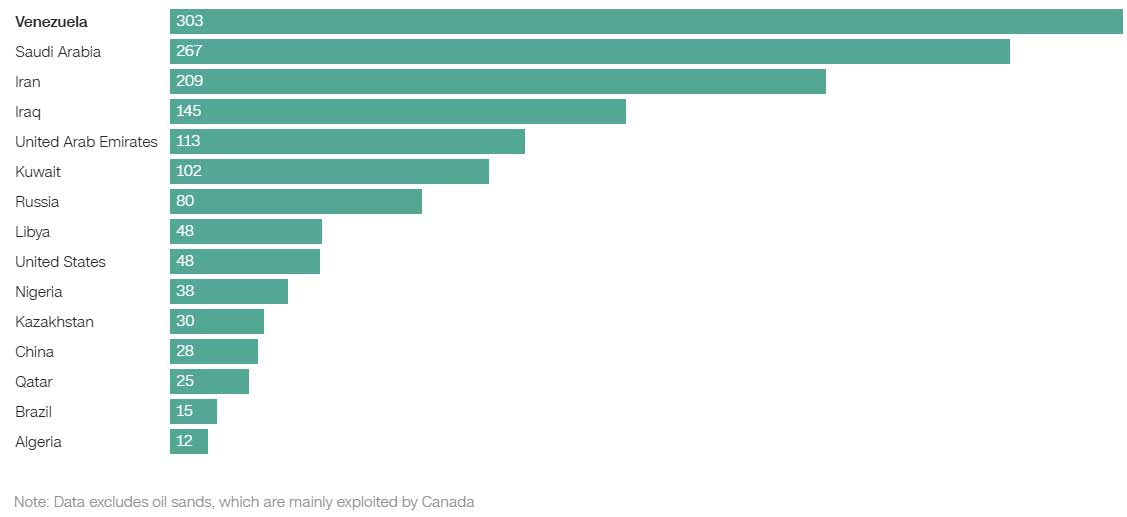

According to the US Energy Information Administration (EIA), Venezuela holds around 303 billion barrels of proven crude reserves, roughly one-fifth of the world’s total. While oil futures do not trade over the weekend, Trump’s comments immediately fueled speculation about the potential long-term implications for supply, prices and geopolitics. Trump said the US would effectively oversee the Venezuelan government in the near term as part of the transition.

“We’re going to have our very large United States oil companies — the biggest anywhere in the world — go in, spend billions of dollars, fix the badly broken infrastructure, the oil infrastructure,” Trump said at a news conference at Mar-a-Lago.

Control of Venezuela’s oil trove

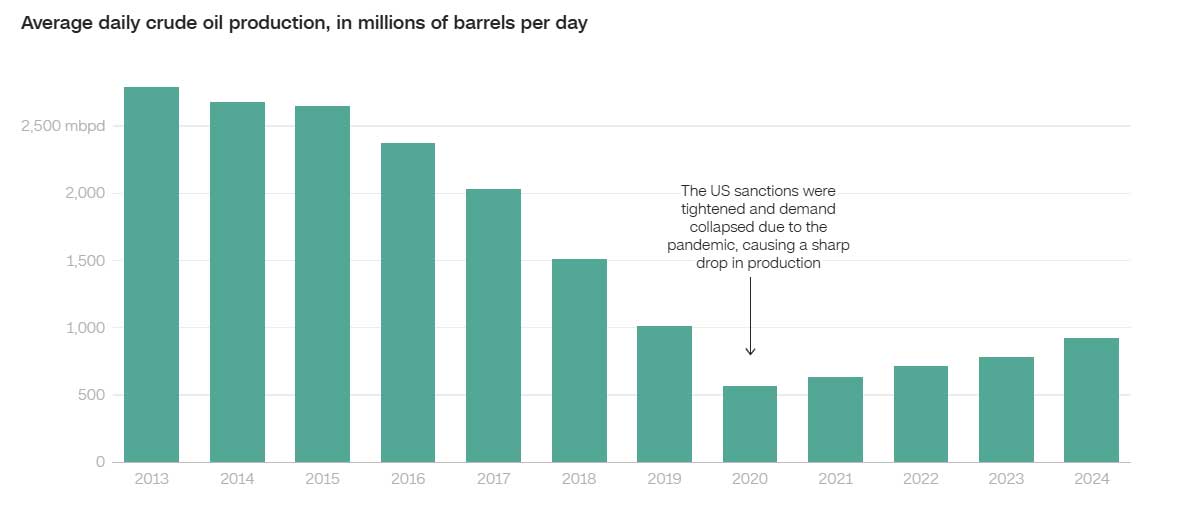

Despite having the world’s largest proven oil reserves, Venezuela’s actual production remains minimal. The country currently produces around 1 million barrels per day, accounting for just 0.8% of global crude output. That is less than half the level seen before President Nicolás Maduro took power in 2013 and less than a third of the 3.5 million barrels per day produced before the Socialist government era.

International sanctions, a prolonged economic crisis and years of underinvestment have all contributed to the industry’s collapse. The EIA notes that Venezuela’s energy infrastructure has deteriorated significantly, sharply reducing production capacity. State-owned oil company PDVSA has said key pipelines have not been upgraded in roughly 50 years, estimating that at least $58 billion would be required to restore output to peak levels.

“For oil, this has the potential for a historic event,” said Phil Flynn, senior market analyst at Price Futures Group. “The Maduro regime and Hugo Chavez basically ransacked the Venezuelan oil industry.”

Limited short-term impact on oil prices

From a market perspective, Venezuela’s current production levels are too low to meaningfully alter near-term global supply dynamics. Oil prices this year have remained under pressure amid oversupply concerns, with OPEC ramping up output while global demand has softened due to persistent inflation and weaker economic growth.

US crude briefly climbed above $60 a barrel when the Trump administration began seizing oil from Venezuelan vessels but later slipped back toward $57. Analysts expect any immediate price reaction to be muted unless the situation escalates into broader instability.

“Psychologically it might give it a bit of a boost, but Venezuela has oil that can be easily replaced by a combination of global producers,” Flynn said.

Venezuela’s oil potential and refinery dynamics

Venezuela’s reserves are largely composed of heavy, sour crude, which requires specialized equipment and advanced technical expertise to extract and refine. While challenging to process, this type of oil is essential for producing diesel, asphalt and fuels used in heavy industry. Diesel, in particular, remains in tight global supply, partly due to long-standing sanctions on Venezuelan oil.

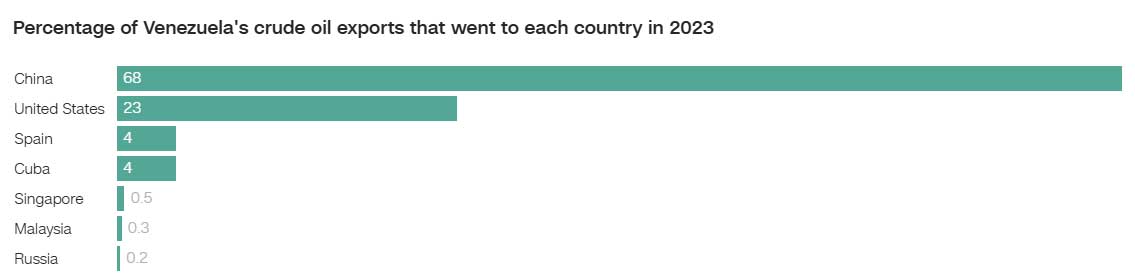

For the United States, renewed access to Venezuelan crude could be strategically attractive. Most US refineries were originally designed to handle heavy Venezuelan oil and operate more efficiently with it than with lighter, sweeter US crude, according to Flynn. Venezuela’s proximity and relatively low-cost barrels further enhance its appeal, despite the additional refining required.

“If indeed this continues to go smoothly — and it looks like a masterful operation so far — and US companies are allowed to go back and rebuild the Venezuelan oil industry, it could be a game-changer for the global oil market,” Flynn said.

Rebuilding an industry from collapse

Trump described Venezuela’s oil sector as “a total bust,” arguing that production has fallen dramatically below its potential. He reiterated that US energy giants would be tasked with repairing infrastructure and restoring output while generating revenue for the country.

“They were pumping almost nothing by comparison to what they could have been pumping,” Trump said.

What’s next for oil markets

Energy analysts caution that any meaningful increase in Venezuelan oil production would take years, not months. Bob McNally, president of Rapidan Energy Group, said the price impact would likely remain modest unless the intervention leads to widespread unrest.

“The prospect is then how quickly could a Venezuela that is pro-US increase its production,” McNally said, adding that market perception may move faster than reality. “Venezuela can be a huge deal but not for 5 to 10 years.”

As oil markets reopen, investors will be watching for signs that the US can deliver a sustained turnaround in Venezuela’s oil sector. Helima Croft, head of global commodity strategy at RBC Capital Markets, noted that success would depend on whether Venezuela breaks with the recent history of failed US-led regime change efforts.

“President Trump signaled the US is back in nation-building mode,” Croft said, emphasizing that far more detail is needed before the market can price in a lasting recovery of Venezuelan oil production.

Ready to start trading Forex? Join iXBroker today and kick-start your trading journey now!