China’s manufacturing sector showed its first expansion in nine months as President Xi Jinping confirmed the country is on track to meet its 2025 growth target of around 5%, signaling resilience amid ongoing economic challenges.

Speaking to the nation’s top political advisory body on New Year’s Eve, Xi highlighted China’s ability to advance “toward the new and the excellent while demonstrating strong resilience and vitality,” according to Xinhua News Agency. He added that the country had “successfully achieved our main economic and social development targets.”

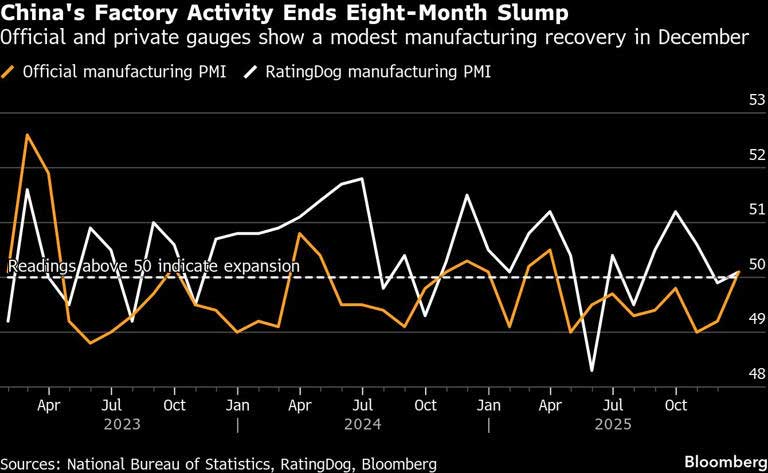

Factory activity climbs above 50

Official data released on Wednesday showed the manufacturing purchasing managers’ index (PMI) rose to 50.1 in December, up from 49.2 in November, marking an end to an eight-month contraction streak. A separate private survey confirmed the expansion, climbing above the 50 threshold that separates contraction from growth.

The recovery is modest but significant, supporting Beijing’s measured approach to economic management rather than broad stimulus measures that many Wall Street analysts had anticipated for 2025.

Larry Hu, head of China economics at Macquarie Group, said, “In the near term, due to robust external demand, policymakers don’t show the urgency to step up stimulus. But if exports slow sharply, Beijing will launch bigger domestic stimulus to fill the gap.”

Market reaction and policy signals

The better-than-expected PMI prompted a sell-off in haven assets, with China’s 30-year bond futures dropping as much as 0.8% and yields rising in the cash market. Policymakers have coupled the recovery with targeted measures to support growth, including 62.5 billion yuan ($8.9 billion) in consumer subsidies for 2026, extended trade-in programs for EVs and electronics, and a tax break on home sales for property held at least two years. Authorities also plan to front-load 295 billion yuan for key projects next year.

Despite these steps, the scale of support is modest compared with 2025, and the People’s Bank of China has kept monetary easing limited, reducing policy rates only once last year. National Bureau of Statistics statistician Huo Lihui noted that 16 of 21 surveyed industries improved, with high-tech manufacturing PMI jumping to 52.5 and expectations for production and business activity reaching their highest since March 2024.

Uneven recovery highlights structural challenges

A deeper look at the data reveals a “two-speed” economy. While the official non-manufacturing index rose to 50.2, services activity contracted for the second consecutive month, highlighting weak consumer demand. Export strength, which has driven a trade surplus exceeding $1 trillion, may also attract growing scrutiny from global partners.

Even within manufacturing, challenges remain. Goldman Sachs economist Yuting Yang noted that a persistent gap between input costs (53.1) and output prices (48.9) is squeezing factory margins, as rising raw material costs force companies to cut prices to clear inventory.

Investment and consumer spending remain weak, and the property sector continues to face headwinds, reinforcing the fragility of domestic demand even as headline PMI numbers improve.

Looking ahead: targeted growth and quality over pace

Xi has emphasized the importance of quality growth over speed, discouraging “reckless” projects while prioritizing high-tech manufacturing and other “new quality productive forces.” Analysts expect Beijing to continue targeted support in 2026, likely focusing on strategic industries aligned with the forthcoming five-year plan scheduled for release in March.

Ready to start trading Forex? Join iXBroker today and kick-start your trading journey now!