Tesla (TSLA) shares fell more than 3% on Monday after reports confirmed that high-profile investor Cathie Wood has once again reduced her exposure to the electric vehicle maker, reigniting debate over whether the stock’s rally has gone too far.

The founder and CEO of Ark Invest has sold an additional $30 million worth of Tesla shares in recent sessions, reallocating capital toward gene-editing companies and autonomous mobility plays. Despite the recent pullback, Tesla stock remains up more than 100% from its year-to-date low, underscoring the scale of its recent run.

Cathie Wood’s move raises questions for retail investors

While Wood’s latest sales do not necessarily signal an outright bearish stance, they do add to growing reasons for retail investors to reassess their Tesla exposure heading into 2026.

Steve Westley, a former Tesla board member, recently warned that the company “will have to bend over backwards” to maintain its recent outperformance. Speaking to CNBC, Westley argued that much of Tesla’s rally over the past nine months has been driven by optimism surrounding robotaxi developments rather than tangible operational progress.

Robotaxi optimism faces growing scrutiny

According to Westley, Tesla remains significantly behind Alphabet’s autonomous driving unit, Waymo, in terms of real-world performance. Waymo reportedly averages around 17,000 miles between critical interventions, compared with roughly 1,500 miles for Tesla. In addition, Waymo is already operating in 20 markets, while Tesla’s robotaxi efforts are currently limited to just two cities.

These comparisons have raised concerns that investor expectations around Tesla’s autonomous ambitions may be running ahead of reality.

Valuation and technical signals add to downside risks

Another key factor weighing on sentiment is Tesla’s stretched valuation. The stock is currently trading at a forward price-to-earnings multiple of nearly 430x, placing it among the most expensive constituents of the S&P 500 Index.

From a technical perspective, Tesla shares also slipped below their 20-day moving average on Monday, a signal that near-term selling pressure could persist.

Westley further cautioned that 2026 could mark Tesla’s second consecutive year of declining sales and shrinking profits, a scenario that would leave the stock poorly positioned at its current valuation. Options market data cited by Barchart also points to potential downside, with implied levels suggesting a move toward the $387 area.

Wall Street remains cautious on Tesla outlook

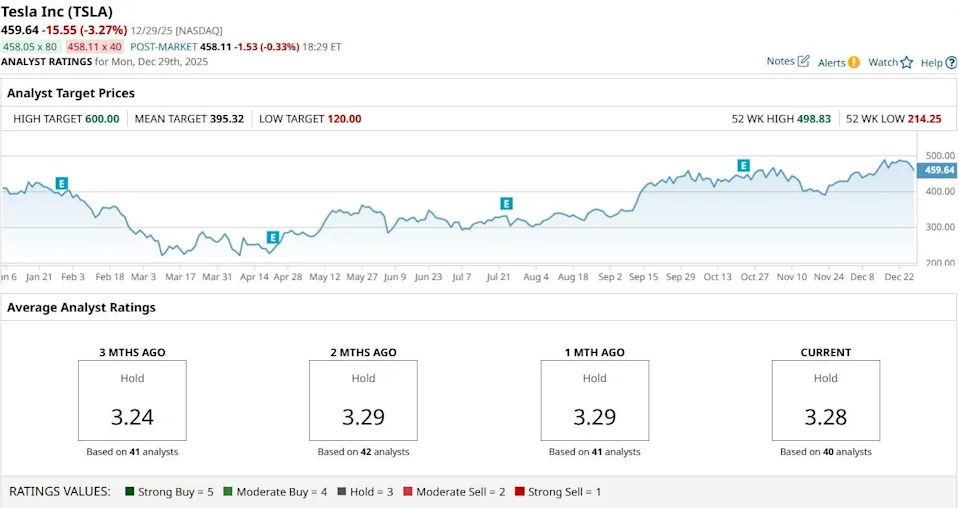

Sell-side analysts appear to share a more restrained view. The current consensus rating on Tesla stock stands at “Hold,” with the average price target near $395, implying more than 13% downside from recent levels.

As Tesla heads into 2026, the combination of elevated valuation, increasing competition in autonomous driving, and cautious analyst sentiment suggests investors may need to temper expectations after an extraordinary rally.

Ready to start trading Forex? Join iXBroker today and kick-start your trading journey now!