According to ixbroker, Bitcoin is trading cautiously amid thin holiday liquidity, with investors weighing persistent ETF outflows against resilient spot market support. While BTC has remained relatively stable, slowing momentum and capital leaving spot Bitcoin ETFs have raised questions about whether the market is consolidating or preparing for a deeper pullback.

At present, price action suggests consolidation rather than panic selling, but near-term direction remains uncertain as liquidity conditions remain tight and sentiment fragile.

Current market conditions

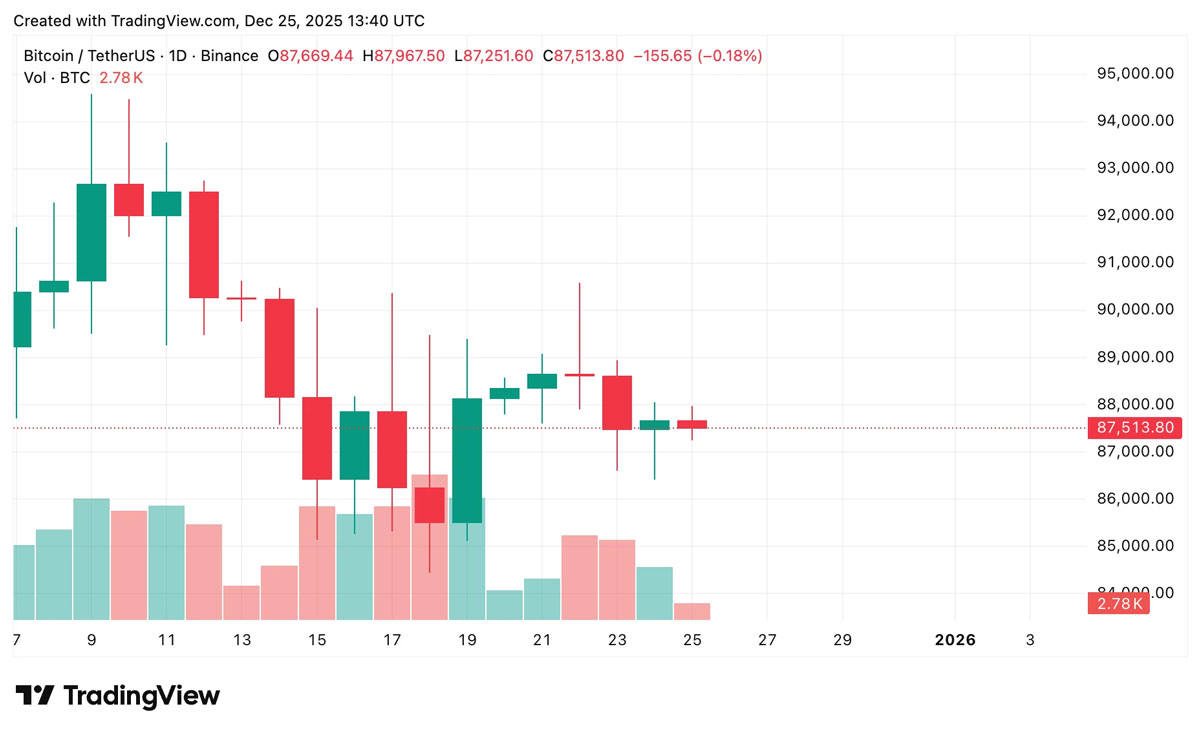

During Christmas trading, Bitcoin is holding near $87,500, up roughly 0.3% over the past 24 hours. BTC remains range-bound between $86,400 and $88,000, reinforcing the view that the market is stabilising rather than breaking down.

The $86,400–$86,700 support zone continues to attract buyers, with repeated rebounds from this area helping to preserve short-term confidence. However, sentiment has been tempered by ETF activity, as spot Bitcoin ETFs recorded net outflows of $175.29 million on December 24. If outflows persist, they could place additional pressure on price in the near term.

Upside outlook remains conditional

From a technical perspective, Bitcoin’s structure remains constructive as long as it holds above short-term support. That said, bulls need a decisive break above the $89,000–$90,000 resistance zone to restore momentum, as this area has consistently capped upside attempts.

A daily close above this region would likely improve sentiment and shift the BTC outlook toward the $93,000–$94,000 range, where prior selling pressure has emerged. Such a move would suggest that ETF outflows are no longer the dominant driver of price action.

Downside risks still in play

Despite near-term stability, downside risks cannot be ruled out. A sustained break below $86,400, particularly if ETF outflows continue, could accelerate losses toward initial support near $85,500.

Further selling would turn the Bitcoin price outlook more defensive, with the $84,000–$82,000 zone coming into focus. In a more bearish scenario, BTC could test the $80,000 level, potentially flushing out weaker hands and late entrants.

Bitcoin price outlook

Overall, Bitcoin remains caught between well-defined support and resistance. Price action continues to reflect consolidation rather than distribution, supported by strong demand near $86,400. However, ongoing ETF outflows remain a key downside risk.

As long as support holds, the BTC outlook stays neutral to cautiously bullish, with potential upside toward $93,000–$94,000. A failure to defend current levels would shift focus lower toward $82,000–$80,000. For now, patience remains warranted as the market searches for clearer direction.

Ready to start trading Forex? Join iXBroker today and kick-start your trading journey now!