Gold prices (XAU/USD) advanced during the North American session on Friday, gaining around 0.30% despite rising U.S. Treasury yields and a stronger U.S. Dollar. The greenback is on track to end the week with modest gains of approximately 0.25%, yet safe-haven flows continued to support bullion. At the time of writing, gold was trading near $4,344 after rebounding from an intraday low of $4,309.

Bullion advances despite higher yields and a steadier Dollar

Trading activity was relatively subdued on Friday as the final full trading week of the year drew to a close and many desks prepared for the Christmas holiday period. The U.S. economic calendar was light, with the University of Michigan’s Consumer Sentiment Index providing the main data point.

The December survey fell short of expectations, showing growing concerns about the labor market and a fifth consecutive monthly decline in spending on durable goods. These findings reinforced gold’s appeal as a hedge against economic uncertainty, even as yields moved higher.

Earlier in the session, New York Federal Reserve President John Williams stated that he does not see a “sense of urgency” to change monetary policy. His tone, perceived as shifting from dovish to a more neutral or mildly hawkish stance, helped the U.S. Dollar recover some ground. Gold prices briefly retreated toward $4,320 before buyers stepped back in, pushing prices to fresh intraday highs.

On a weekly basis, gold reached a high of $4,374 on Thursday. However, bulls remained cautious about testing the year-to-date peak at $4,381, particularly as global bond yields advanced. U.S. Treasury yields climbed further after the Bank of Japan raised its policy rate from 0.50% to 0.75% on Friday.

Looking ahead, next week’s U.S. economic calendar will be busier despite being shortened by the Christmas holidays. Market participants will focus on the ADP Employment Change four-week average, preliminary Q3 GDP figures, October Durable Goods Orders, and Industrial Production data for October and November.

Market drivers: Gold supported by weaker consumer sentiment

Gold prices rallied even as both U.S. yields and the U.S. Dollar posted solid gains. The U.S. 10-year Treasury yield rose by roughly 2.5 basis points to 4.147%, while real yields climbed nearly three basis points to around 1.907%, a move that typically pressures gold.

Meanwhile, the U.S. Dollar Index (DXY), which measures the Dollar against a basket of six major currencies, advanced 0.22% to 98.63.

U.S. Consumer Sentiment for December was revised down to 52.9 from 53.3, missing market expectations of 53.5. The University of Michigan survey also showed one-year inflation expectations rising to 4.2%, while five-year expectations remained unchanged at 3.2%, suggesting that longer-term inflation expectations remain elevated but stable.

Fed President John Williams noted that recent data continue to point toward disinflation and suggested that the recent uptick in the unemployment rate may be driven by temporary distortions. As a result, he emphasized that there is no immediate need to adjust monetary policy.

Data released on Thursday showed that U.S. Consumer Price Index (CPI) inflation eased to 2.7% in November, down from 3% previously. However, economists cautioned that the figures may be distorted by the recent 43-day U.S. government shutdown.

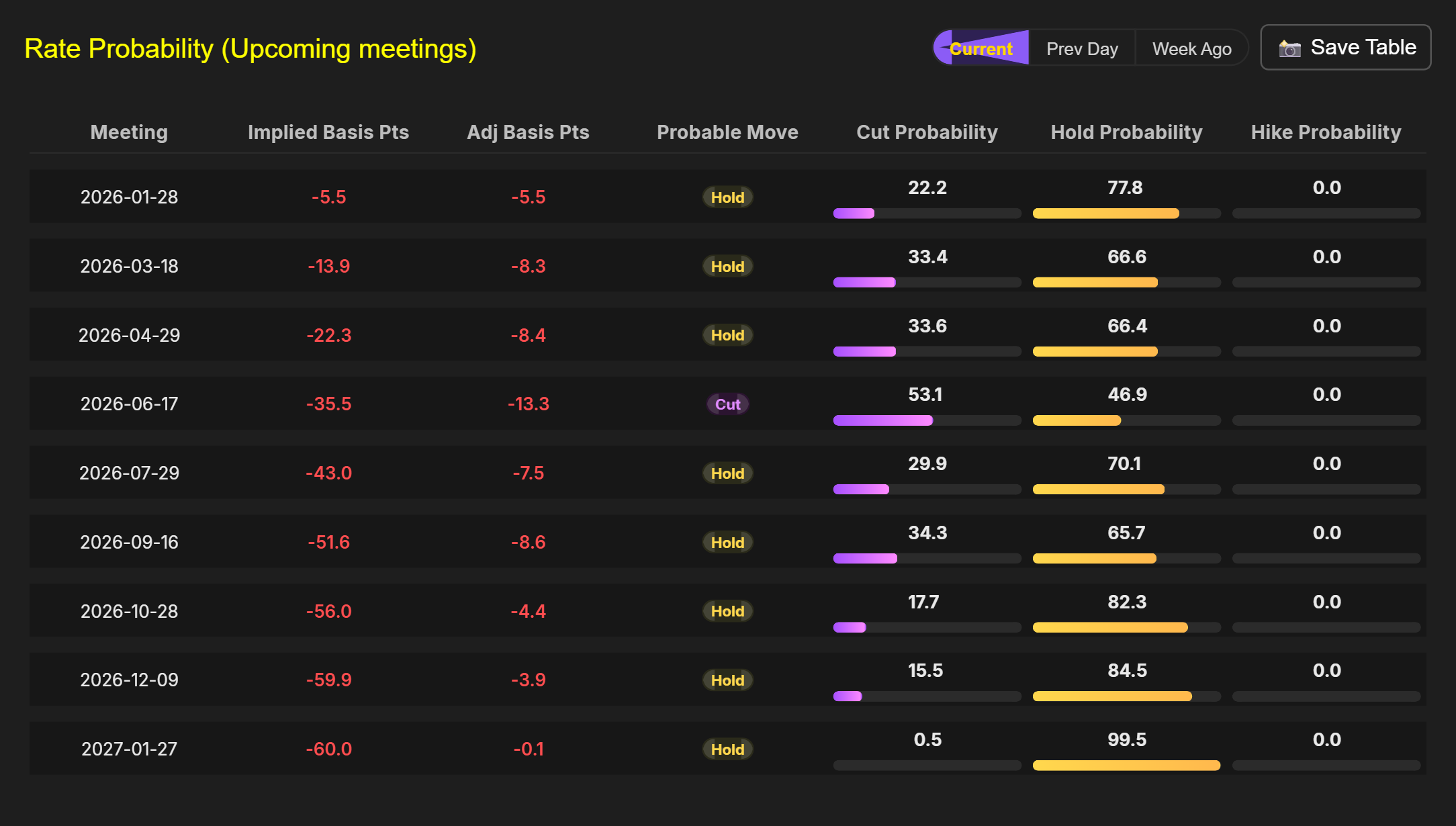

According to Capital Edge rate probability data, expectations for a Federal Reserve rate cut at the January 28 meeting remain steady at 22%. For the year ahead, markets are pricing in roughly 60 basis points of easing, with the first rate cut anticipated around June.

Technical outlook: Gold consolidates below record highs

From a technical standpoint, gold’s broader uptrend remains intact, though momentum has slowed as prices consolidate near year-end. Despite the pause, bullion is on track to finish the year with gains exceeding 60%, keeping longer-term targets near $4,500 and $5,000 in focus for the year ahead.

For bullish continuation, XAU/USD must break decisively above the record high at $4,381, opening the door toward $4,400, followed by $4,450 and $4,500. On the downside, a move below $4,300 could expose the December 11 high at $4,285, with further support seen at $4,250 and the psychological $4,200 level.

Overall, gold remains well supported by safe-haven demand, even as higher yields and a firmer Dollar limit upside momentum in the near term.

Ready to start trading Forex? Join iXBroker today and kick-start your trading journey now!