The Dow Jones Industrial Average (DJIA) extended its slide on Tuesday, dropping another 1,750 points in a second consecutive soft session as markets positioned ahead of the Federal Reserve’s (Fed) widely expected rate cut. Investors are awaiting the December 10 policy decision, where the Fed is forecast to deliver a third straight quarter-point reduction alongside updated projections in the Summary of Economic Projections (SEP).

While the S&P 500 (SP500) edged 0.1% higher and the Nasdaq gained 0.2%, the Dow retreated 0.35%. Fed funds futures now price in roughly an 87% probability of a rate cut, a significant rise from expectations just one month earlier.

Traders say the combination of the policy outcome and Fed Chair Jerome Powell’s tone – delivered in one of his last press briefings of his term—will likely dictate market sentiment into year-end as investors grapple with persistent inflation, delayed data releases, and the long transition toward new Fed leadership in 2026.

Markets eye fed leadership outlook

Beyond the immediate rate decision, analysts note that markets are increasingly looking toward the next phase of Fed leadership and potential changes in communication strategy after a year marked by volatile pivot expectations. With the dual mandate still tested by uneven inflation and a cooling labor market, investors are watching whether policymakers can sustain an accommodative approach through 2026 or whether economic pressures will force a more cautious stance.

Rate-sensitive stocks outperform on cut expectations

Rate-linked sectors were the day’s strongest performers. The Russell 2000 surged to a fresh intraday record as small-cap names benefited from the prospect of lower borrowing costs. Silver miners also rallied, tracking Silver futures to a new all-time high above $61 per ounce. Corporate announcements added further momentum: CVS advanced on an improved profit outlook, and Colgate-Palmolive (CL) climbed following an analyst upgrade.

Macro signals were mixed. JOLTS job openings remained stable through September and October, though both hiring and quits rates eased heading into Q4. Meanwhile, small business inflation concerns rose to their highest level since early 2023 as tariff pressures continued to weigh on underlying economic activity.

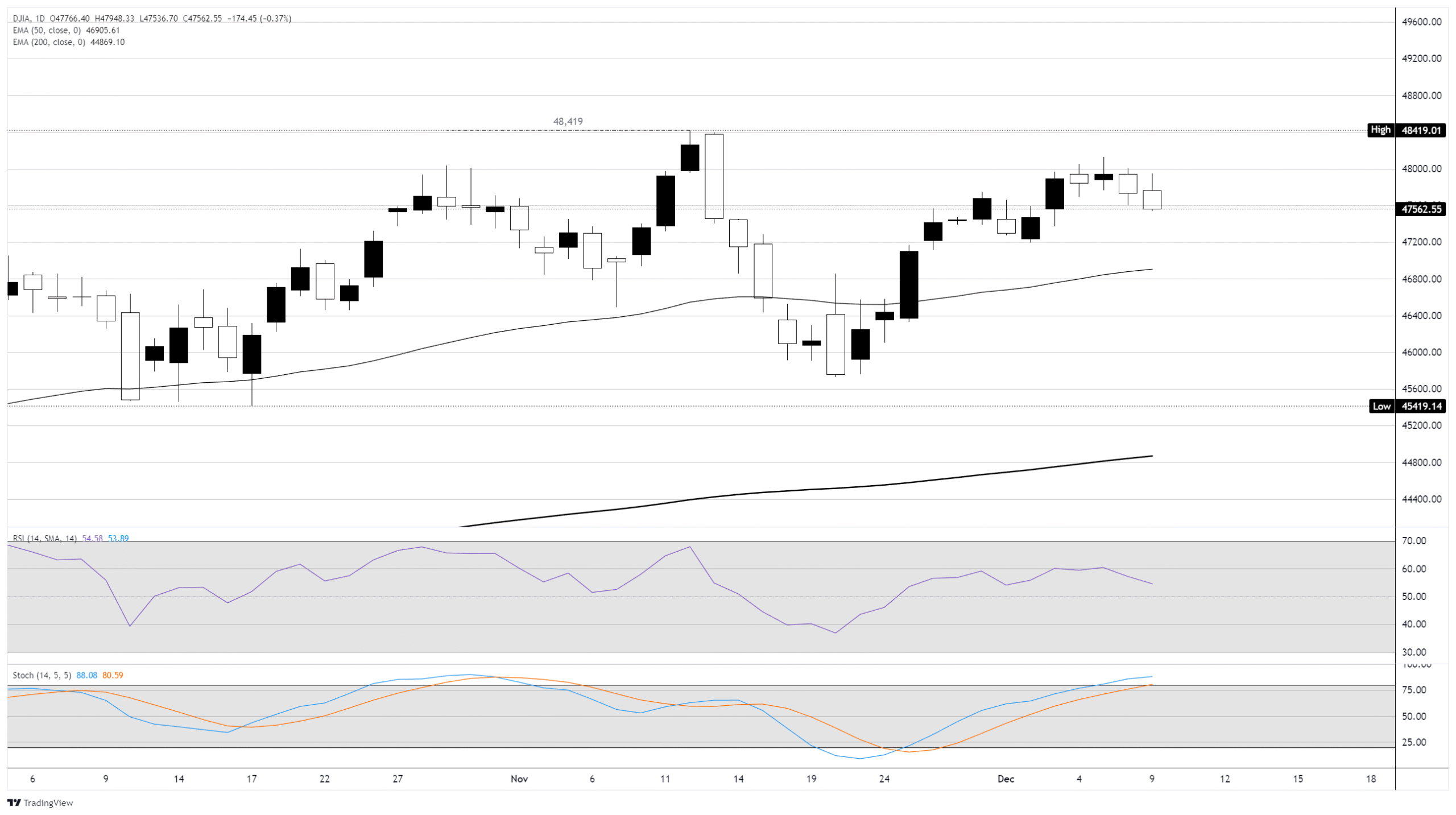

Dow jones technical outlook

The Dow Jones daily chart reflects mounting downside pressure as sentiment weakens ahead of the Fed. Investors will be watching whether the index can stabilize following this week’s policy announcement or if further volatility is on deck.