Firefly Aerospace has officially filed for an IPO, signaling a bright future with growing revenues and backlog as it aims to expand its space projects.

Lead:

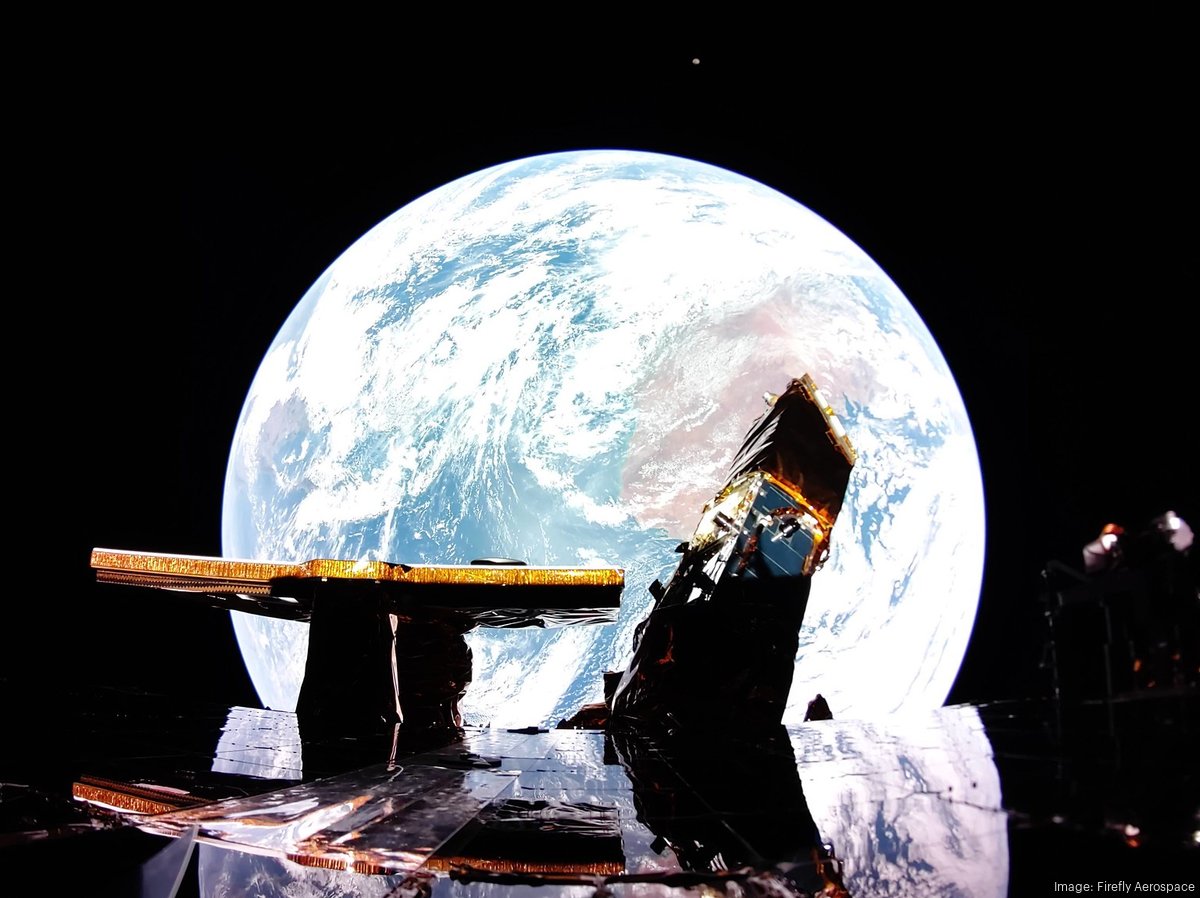

Firefly Aerospace, a key player in the private space industry, has submitted its IPO registration with the U.S. Securities and Exchange Commission, aiming to raise significant capital to further develop its space ventures. This move follows the company’s major milestones, including the first commercial moon landing.

Details of Firefly Aerospace’s IPO

Firefly Aerospace recently filed its formal application for an initial public offering with the U.S. Securities and Exchange Commission (SEC). This critical step marks the company’s intent to enter the public capital markets in 2025. The submitted S-1 document provides comprehensive insights into the company’s financial standing, management structure, and future plans. However, specific details regarding the number of shares to be offered and their price range have yet to be disclosed, leaving the company’s final valuation to be determined at the time of offering.

Financial Position and Liquidity

The company is entering the public market with $176.9 million in cash and cash equivalents. Despite operating losses and negative cash flows, Firefly projects that its current cash reserves will sufficiently cover liquidity needs for at least the next 12 months. Nevertheless, the company carries significant debt, totaling approximately $173.6 million, including a $136.1 million term loan with an interest rate of 13.87%. A portion of the proceeds from the IPO is expected to be allocated toward repaying these outstanding loans.

Revenue Growth and Q1 2025 Performance

Firefly Aerospace reported revenues of $55.8 million for the first quarter of 2025, showing a substantial increase from $8.3 million during the same period last year. The majority of this revenue—over $50 million—came from “spacecraft solutions,” primarily the Blue Ghost lander missions, while around $5 million was generated from launch services. However, the cost of producing hardware remains high; cost of sales during this period was approximately $53 million, resulting in a modest gross profit of $2.2 million.

Operating Losses and Future Outlook

For the fiscal year 2024, Firefly Aerospace recorded a net loss of $231.1 million, up from a $135.5 million loss in 2023. The company’s net loss at the end of the first quarter of 2025 was $60.1 million. Despite these losses, Firefly assures prospective investors of a strong growth trajectory, backed by several significant projects currently underway that promise to transform the company’s prospects.

Key Projects and Strategic Partnerships

Among the company’s major upcoming initiatives is a collaboration with defense giant Northrop Grumman to develop Eclipse, a reusable launch vehicle. Firefly has also signed a launch agreement with Lockheed Martin for up to 25 missions. Additionally, the company is preparing to unveil Elytra, a new line of spacecraft designed to provide in-space transportation services. These projects are expected to be transformative for the space market.

Significant Increase in Backlog Orders

As of March 2025, Firefly Aerospace had approximately $1.1 billion in backlog orders, nearly doubling the $560 million reported a year earlier. This surge primarily stems from three multi-launch contracts for the company’s small Alpha rocket, alongside a new lunar delivery contract for the Blue Ghost lander. This growing backlog reflects the market’s and customers’ confidence in Firefly’s technology and capabilities.

Conclusion

Firefly Aerospace’s entry into public capital markets not only presents a vital opportunity to secure essential funding for advanced space technologies but also demonstrates investor confidence in the company’s long-term vision. With significant projects and large-scale orders underway, Firefly is positioned to become a key player in the space industry, heralding a promising future.