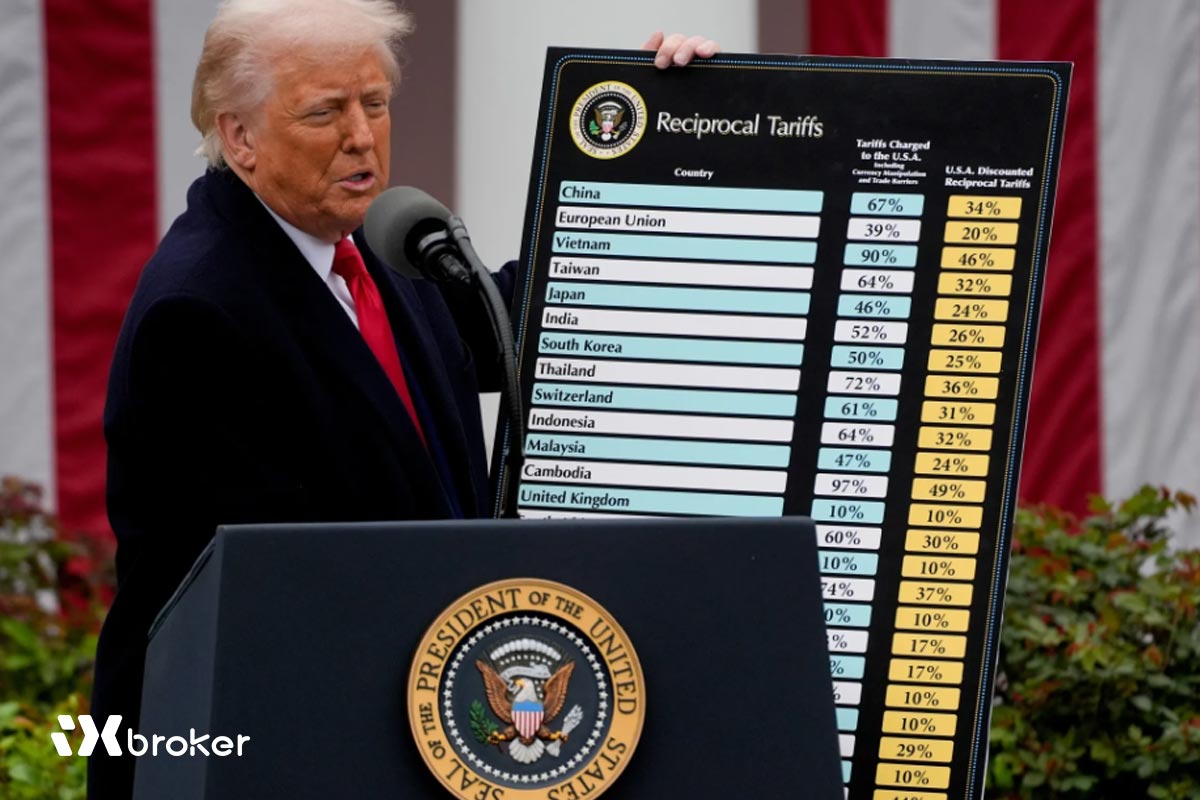

US President Donald Trump escalated trade tensions on Friday, announcing new tariffs on Chinese imports following Beijing’s decision to tighten export licensing requirements for critical rare earth minerals.

In a social media post, Trump declared that a 100% tariff would be imposed on all Chinese exports to the United States, signaling a renewed phase of trade hostilities.

Markets face uncertainty amid US government shutdown

While the announcement adds to global market uncertainty, the practical implementation of the tariffs remains unclear. The US government is currently in a partial shutdown after the Senate failed to reach an agreement on funding federal operations. This impasse complicates the ability to both impose and collect new trade taxes at the border, leaving details of enforcement largely unresolved.

Global trading environment subdued

Markets were already subdued ahead of the Columbus Day long weekend, with US exchanges closed and trading volumes thin. Treasury yields spiked heading into Friday’s close, reflecting investor caution, and sentiment is expected to shift sharply when markets reopen on Tuesday. The combination of renewed tariff threats and ongoing federal gridlock has heightened risk aversion, leaving investors bracing for potential volatility in equities, currencies, and commodities in the coming days.

Overall, Trump’s latest tariff move underscores persistent uncertainty in US–China trade relations, with the broader financial landscape now preparing for the implications of both heightened trade risk and domestic fiscal deadlock.